Turns Out the Crisis Wasn’t All About Subprime: Megan McArdle

©2015 Bloomberg View

NUOQ0K6JTSEB

(Bloomberg View) — When we talk about the past decade’s housing crisis, it’s natural to talk about subprime loans. Subprime loans give us a convenient, conventional story: predatory lenders charging people unconscionable interest rates, forcing innocent people into foreclosure and the rest of us into the worst financial crisis since the Great Depression.

There is only one small problem with this story, which is that lots of prime borrowers defaulted too. In fact, according to a new paper by Fernando Ferreira and Joseph Gyourko, subprime loans accounted for only a bare majority of defaults at the beginning of the housing crisis. Between the third quarter of 2006 and the third quarter of 2012, twice as many prime borrowers lost their homes as subprime borrowers.

This is not a phenomenon that can be simply explained by liar loans, predatory lenders, or any other narrative that neatly loads all the blame onto a few greedy and heedless lenders, or a somewhat larger number of hubristic and speculative borrowers. Subprime loans certainly caused a lot of problems, but they did not cause all the problems by any means. They could not have driven us into crisis if the rest of us had not so eagerly gone along.

So what role did they play? I think we can tell a very plausible story that still assigns subprime loans a central role:

Once upon a time, there was a country with a housing market that started to rise. As the market started to rise, housing defaults started to fall. They fell not because people had gotten wiser about borrowing, or better at managing their money, but because borrowers in a rising housing market virtually never need to default; they can always simply sell the house, walking away with whatever equity is left over after paying off the mortgage.

Lenders loved this. “Splendid! If default has become less likely,” the lenders said, “we do not need to worry so much about things like down payments or credit histories. Who cares if they can’t pay the mortgage each month; if they get into trouble, they’ll just sell the house and pay us.”

Now, a housing market is sort of like a room with two doors. On the one side people are entering; on the other side of the room, people are exiting. The more people there are in the room, the more valuable your little patch of ground to stand on becomes. The effect of expanding subprime loans was to make the entrance door wider, allowing a lot of people in who had not previously been able to secure a spot inside. This made spots inside even more valuable, and drove defaults even lower, encouraging the bankers to make even riskier loans.

Unfortunately, there were only so many people in the waiting room who wanted to get in. Once they’d all passed through, two things happened: The number of people bidding for spots fell, and people started to notice that it was getting kind of crowded in there. Prices stopped rising inside.

Once that happened, the risk of those subprime loans became apparent. They’d always been bad credit risks, but that risk had been masked by the rising prices. Defaults started going up. The folks in the waiting room decided maybe they’d wait a little while to see how it settled out. Lenders didn’t have money to make new risky loans. The subprime borrowers were the first to go, and the hardest hit. But without those subprime borrowers to fuel the bidding, prime borrowers suddenly found they’d overbid on their own slots.

They had, in the dread banker’s parlance, “negative equity.”

In other words, had we not been making risky loans to so many new borrowers, the bubble would probably not have expanded as rapidly as it did. But the subprime borrowers were not the only people, or even the majority of people, bidding on homes. Most of the bidding was done by better credit risks, with perfectly conventional loans. The buyers and the banks simply underestimated the risk that the prices of these homes would fall. And when prices fell, prime borrowers caught in bad situations — deteriorating neighborhoods or deteriorating finances — had little alternative but to default. Which is why your risk of default is best predicted, not by the type of loan you got or how much you put down, but by whether you had negative equity.

So while initial down payments may not have done much to predict default in individual cases, we could argue that requiring 20 percent down would still have done a lot to prevent so many people in the market from going into default. The down payment is the biggest obstacle most people face to getting into a house. Closing the door to anyone who couldn’t get that much cash together would have kept houses much more closely tied to incomes, meaning that the bubble simply could not have inflated as large as it did — and therefore, would not have had the same catastrophic effects coming down.

That doesn’t mean that tightening up lending standards would have prevented the bubble. But it could have kept the bubble smaller, and the fallout less vicious.

Of course, it’s easy to say this in hindsight. It was a lot harder to develop insight at the time. When prices had been in a long, gentle rise for decades, high down payments looked like expensive and unnecessary insurance against something that rarely happened. They looked like a barrier keeping historically disadvantaged groups, like minorities and immigrants, from accumulating wealth the way that prosperous native white families had. They looked like something that regulators and bankers had needed to require before they got so darn smart about managing credit risks, and credit markets.

Everyone, from buyers to regulators, had reams of data telling them this. Who are you going to believe: years and years of statistics, or some crabby dude muttering about the Great Depression? The Great Depression was so long ago that men wore hats and the Beatles were not even gleams in their fathers’ eyes.

Bubbles are not fundamentally about evil people doing evil things. They are not even about stupid people doing stupid things. No, the problem with bubbles is worse: It’s quite ordinary people, doing stupid things that a trick of the light has made appear very smart.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author of this story: Megan McArdle at mmcardle3@bloomberg.net To contact the editor responsible for this story: Philip Gray at philipgray@bloomberg.net

For more columns from Bloomberg View, visit http://www.bloomberg.com/view

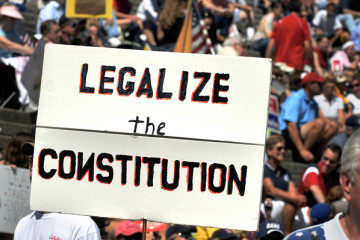

No Comment