Your Money

Articles to keep you informed about trends and help you manage your money

Soaring Consumer Confidence: Are Americans Happy It’s Trump, or Just Happy It’s Over?

published Nov 23rd 2016, 11:12 am, by Luke Kawa and Julie Verhage (Bloomberg) — On the surface, the message from the University of Michigan’s final reading of consumer sentiment for November is that President-elect Donald Trump will fix what ails the nation — fast. The consumer expectations index of the

What the Rich Are Doing Now to Reap Trump’s Tax Bonanza

published Nov 14th 2016, 6:00 am, by Ben Steverman (Bloomberg) —For wealthy Americans, the outcome of the 2016 election could be lucrative. Democratic candidate Hillary Clinton proposed hiking their taxes. Donald Trump, her Republican rival and now the president-elect, proposed the opposite: $6.2 trillion in tax cuts over the next decade,

Is Trump Going to Mess With Your Investments? Seven Tips

published Nov 9th 2016, 1:25 pm, by Suzanne Woolley (Bloomberg) — Financial planner Timothy LaPean is watching a wave of fear and confusion sweep over clients after Donald Trump’s stunning election as U.S. president. They aren’t just freaking out about their investments. In a sign of the impact of Trump’s

It’s Better to Buy Than to Rent, and It Probably Always Will Be

published Oct 20th 2016, 6:00 am, by Patrick Clark (Bloomberg) — Is it better to buy or rent your home? This is a somewhat silly personal finance trope that assumes a reader is a) living under a bridge and b) has a suitcase full of enough cash to afford a

You Risk a Ragged Retirement If You’re Counting On These Numbers

published Nov 1st 2016, 5:00 am, by Suzanne Woolley (Bloomberg) — If you’re relying blindly on hallowed personal finance averages—planning for 40 years of work, saving 15 percent of salary—you could be in for a rocky retirement. Retirement advice is made to be tailored to our needs and the times.

The Next 10 Years Will Be Ugly for Your 401(k)

published Oct 26th 2016, 5:00 am, by Suzanne Woolley (Bloomberg) — It doesn’t seem like much to ask for—a 5 percent return. But the odds of making even that on traditional investments in the next 10 years are slim, according to a new report from investment advisory firm Research Affiliates.

The People There to Help With Student Loans Are Less Than Helpful

published Oct 13th 2016, 8:07 am, by Shahien Nasiripour (Bloomberg) — College financial aid counselors are supposed to be students’ primary resource to help figure out how to pay for school—determining how much they’ll need to borrow, the types of loans best suited for them, and sources of cash. But

How to Play Sunday’s Debate: A Personal-Finance Guide

published Oct 7th 2016, 4:00 am, by Suzanne Woolley (Bloomberg) — It’s the economy again, stupid. The presidential race has been dominated by debate over job creation, retirement, and other tenets of economic security, along with looming questions over race in America and threats from abroad. The future of Social

Matt Levine’s Money Stuff: Illegal Stock Tips and Risky Loans

published Oct 5th 2016, 8:17 am, by Matt Levine (Bloomberg View) — Insider trading. I don’t know what else there is to say about the Salman insider trading case being argued before the Supreme Court today, but I guess Salman’s and the government’s lawyers will find something. If you pass inside

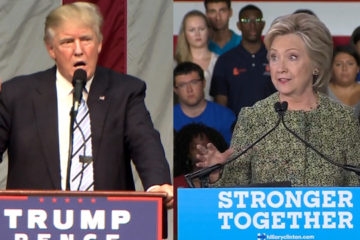

How the Next President Will Manage Your Money—And What to Do About It Now

published Sep 26th 2016, 6:17 am, by Suzanne Woolley (Bloomberg) — Jobs and wages. Taxes and Social Security. Student debt and retirement. Child care. These are just a few of the crucial areas in which the policies of the next president will affect the financial security of all Americans, and