Investors Look Past Trade War Amid Risk-On Sentiment: EM Review

published Sep 21, 2018, 3:30:25 PM, by Yumi Teso, George Lei and Alex Nicholson (Bloomberg) — Emerging-market stocks, currencies and bonds were unfazed by an escalation in the U.S.-China trade dispute, rising for a second week as the dollar retreated. Assets Weekly Moves MSCI EM stocks index +2.22 percent MSCI

Default Rattles Investors in Asia’s Best-Performing Stock Market

published Sep 23, 2018, 3:30:00 PM, by Abhishek Vishnoi and Santanu Chakraborty (Bloomberg) — The turmoil in India’s non-bank finance companies is deepening, with a troubled lender disclosing further missed debt payments late on Friday and panic seeping into what has been Asia’s best-performing stock market. The benchmark equity index

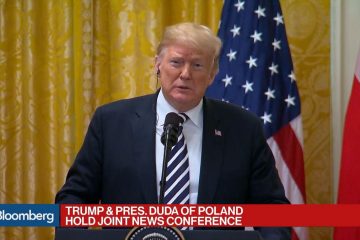

Trump Is Denying Product Exclusions From New China Tariffs

published Sep 20, 2018, 8:21:08 PM, by Jenny Leonard and Mark Niquette (Bloomberg) — The Trump administration hasn’t put a process in place for companies to get exemptions from 10 percent tariffs it’s imposing on $200 billion of Chinese goods, unlike earlier rounds of the duties, four people familiar with

Women and Family: Beat the Bully by Brad Weisman

We often watch the bully of the school own peoples words and behavior, but that is not right. We believe at an early age the bully is a person of great strength and power. However, it is actually not the bully that is tough. We can talk about that in

Ben Carson and HUD Get Ready to Take On the Nimbys: Noah Smith

published Sep 12, 2018, 6:30:12 AM, by Noah Smith (Bloomberg Opinion) — According to official statistics, Americans have been getting slowly richer since 1980. Real median personal income growth slowed in the 2000s and took a big hit in the Great Recession, but has now recovered and is at an

Pot Stocks Bring Out the Worst in Investors: Robert Burgess

published Sep 19, 2018, 3:41:12 PM, by Robert Burgess (Bloomberg Opinion) — More than a few commentators are talking about how the rally in marijuana stocks has officially become a bubble. Just take a look at Canadian cannabis company Tilray Inc., whose shares about doubled on Wednesday to $300 each

Trump Says He Wants to Hear From Woman Who Accuses Kavanaugh

published Sep 19, 2018, 4:52:15 PM, by Toluse Olorunnipa and Laura Litvan (Bloomberg) — President Donald Trump said he wants to hear from the woman who accuses Supreme Court nominee Brett Kavanaugh of sexual assault, saying it would be “unfortunate” if she doesn’t testify before a Senate committee. “If she

Investors Love Chinese Tech Stocks

published Sep 19, 2018, 1:42:20 PM, by Shelly Hagan and Drew Singer (Bloomberg) — X Financial rose 114 percent in its first trading day before paring gains to 24 percent, reinforcing signs that investors are embracing Chinese tech companies listing on U.S. exchanges. The peer-to-peer lending firm is the latest

Parsing the Fed’s Labor Participation Puzzle: Eco Research Wrap

published Sep 18, 2018, 9:00:00 AM, by Jeanna Smialek (Bloomberg) — In the 2000 film Miss Congeniality, the beauty pageant contestant from Rhode Island is asked to describe her perfect date. She answers that it’s April 25 “because it’s not too hot, not too cold.” Call this America’s April 25

October Is Brexit’s `Moment of Truth,’ Barnier Tells U.K.

published Sep 18, 2018, 4:19:20 PM, by Ian Wishart (Bloomberg) — The European Union’s chief Brexit negotiator warned U.K. Prime Minister Theresa May that substantial progress on the U.K.’s orderly withdrawal from the bloc is needed next month if there’s to be a deal. “October will be the moment of