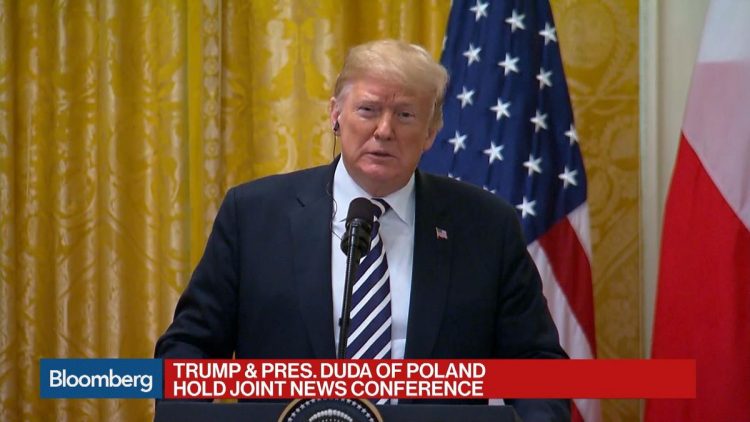

Key House Democrat Says He’s `Intent’ on Trump Tax Return Demand

(Bloomberg) —

Democrats are in discussions about the best way to get the Treasury Department to hand over President Donald Trump’s tax returns, according to the incoming chairman of the House Ways and Means Committee.

“We don’t have a timetable yet, but we’ve talked about it, and we are certainly intent on doing it,” Representative Richard Neal, a Massachusetts Democrat who will lead the committee next year, told reporters Tuesday.

The heads of the House and Senate tax-writing committees have the authority to request any individual tax return from the Treasury secretary, including the president’s. Trump departed from roughly 40 years of tradition for presidential candidates by refusing to release his tax returns during the 2016 campaign. The forms, or some of the information they contain, could effectively become public if the committee votes to release them.

In practice, however, the process could turn into a protracted legal battle if Treasury Secretary Steven Mnuchin decides to delay sending the tax documents to Congress. Trump’s attorney Rudy Giuliani has also said Democrats could face difficulties making the case that the request is for oversight purposes, rather than being politically motivated.

Neal said exactly how he plans to request the returns is still under review. “This has got to be done through counsel and you’ve got to make sure all of our legal requirements are met,” he said.

No Comment