Buffett Skirts Controversy as Politics Intrude on His Omaha Bash

published May 6, 2018, 3:03:22 PM, by Katherine Chiglinsky and Noah Buhayar

(Bloomberg) —

Even Warren Buffett can’t escape the political and social debates that have spilled over into the corporate world.

Tens of thousands of investors descended on Omaha, Nebraska, over the weekend to hear him speak about business and the economy at the annual meeting of Berkshire Hathaway Inc., the conglomerate he’s been building for five decades. But many also wanted to hear the famous investors take stances on some of the most-divisive issues of the day.

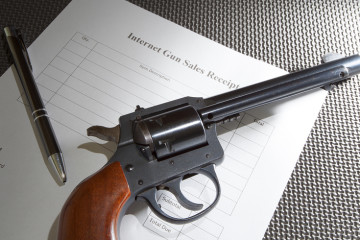

Shareholders asked the 87-year-old billionaire to weigh in on the Trump administration’s trade policies, guns and gender equality. But he mostly skirted controversy, sticking with beliefs that may have surprised some attendees but ultimately won over many.

“There are so many things at Berkshire that could be politicized, and he did a good job of nipping that in the bud,” said David Rolfe, chief investment officer at money manager Wedgewood Partners, which oversees about $4.2 billion and counts Berkshire among its largest holdings. “Everything these days is politicized.”

Under Pressure

Companies have long heard demands from activists, but banks and investors are increasingly facing pressure to use their monetary clout to wield power normally afforded to lawmakers. These debates have spurred changes at some large companies, including Bank of America Corp, which decided it would no longer finance makers of assault-style weapons sold to consumers. Dick’s Sporting Goods Inc., meanwhile, vowed to limit sales of certain types of firearms, and has even retained a company to lobby Congress on gun control.

Buffett has tended to stake out neutral territory, even as people continue to urge the Berkshire chief executive officer to explain and potentially reconsider his views. He said in February that he didn’t think he should force his personal beliefs upon Berkshire and its managers and shareholders.

On Saturday, a shareholder submitted a question about that stance, citing Buffett’s decades-old testimony before Congress after he took over troubled Salomon Brothers. The shareholder said it was a symbol of what it meant for a business leader to “have a moral compass” and seemed at odds with his later position on guns. Other investors applauded the question.

“I do not believe in imposing my political opinions on the activities of our businesses,” Buffett responded, saying that he wouldn’t ask Geico — Berkshire’s auto insurer — to question potential customers about their affiliation with the National Rifle Association. The response drew even bigger applause.

The annual meeting, at which Buffett and his 94-year-old business partner Charles Munger take questions for hours, generally has the vibe of a festival, with investors eating Dairy Queen Dilly bars as they wander around booths showcasing Berkshire’s other businesses. Yet over the years, the event has drawn protesters ranging from climate activists to even pilots at Berkshire’s NetJets who were fighting over labor contract negotiations.

“This historically has been a festive environment and a celebration of what Berkshire has accomplished,” Jim Shanahan, an Edward Jones & Co. analyst, said in an interview. This year seemed “a little bit more awkward and uncomfortable in the morning than I’ve experienced in the past.”

Wells Fargo

Some attendees questioned his investment in Wells Fargo & Co., which has been reeling from a phony-account scandal. Buffett was firm in his support of the bank, where Berkshire is the largest shareholder. He repeated his view that the lender had made mistakes and had the wrong incentives in place.

“The fact that we’re going to have problems at some very large institutions is not unique, in fact almost every bank has, all the big banks, have had troubles of one sort or another,” Buffett said. “I see no reason why Wells Fargo as a company from both an investor standpoint and a moral standpoint going forward is in any way inferior to the other big banks with which it competes.”

See also: Buffett says his rock star pickers ‘slightly’ beat the S&P 500

A supporter of Hillary Clinton in the 2016 presidential election, Buffett has carefully avoided directly addressing some of President Donald Trump’s actions and policies. On Saturday, he expressed optimism that the U.S. and China would resolve an increasingly tense trade relationship, and said that extreme partisanship in America is making people miss the overwhelming potential of business in the country.

“He’s very cautious and he’s politically savvy,” Shanahan said. “I think he probably avoids trying to create controversy.”

One thing Buffett dwelled on at length during the meeting was a new accounting rule that may lead to “wild” swings in net income numbers. That helped fuel a $1.14 billion loss in the first quarter — Berkshire’s first since 2009 — even as operating profit jumped 49 percent to $5.29 billion. Buffett also sought to reassure investors that Berkshire will remain active in dealmaking after he’s gone, saying it will still be the first call for firms looking for a buyer.

There was one clash that Buffett and Munger didn’t avoid this year. The business partners have long emphasized that companies with high barriers to entry — so-called moats — will enjoy competitive advantages over those that don’t. Tesla Inc. founder Elon Musk has called the idea “lame,” saying that a business will not last long if that is its only defense against invasion. On Saturday, Buffett pushed back, saying that there are still pretty good moats around.

“Elon may turn things upside down in some areas,” Buffett said. “I don’t think he’d want to take us on in candy.”

He was wrong. Musk, tweeted Saturday that he was starting a candy company and that it would be “amazing.”

“I am super, super serious,” he wrote.

–With assistance from Sonali Basak and Hannah Levitt.To contact the reporters on this story: Katherine Chiglinsky in New York at kchiglinsky@bloomberg.net ;Noah Buhayar in Seattle at nbuhayar@bloomberg.net To contact the editors responsible for this story: Michael J. Moore at mmoore55@bloomberg.net Steven Crabill

COPYRIGHT

© 2018 Bloomberg L.P

No Comment