Asia Stocks Set for Volatile Day After U.S Selloff: Markets Wrap

(Bloomberg) —Volatility was set to spread across Asian equity markets after turmoil surrounding Donald Trump’s administration sparked the worst day in eight months for U.S. stocks as investors rushed toward haven assets.

Equity index futures in Australia, Japan and South Korea pointed to losses of more than 1 percent after the S&P 500 Index plummeted by the most since September. Gold had its biggest one-day rally since the aftermath of the Brexit vote and Treasury yields dropped to an almost one-month low as bets on a Federal Reserve rate increase next month were pared. The Bloomberg Dollar Index steadied in early trading Thursday after declining to the level it was at around the U.S. elections.

A gauge of U.S. stock volatility surged the most since the U.K. voted to leave the European Union last June, as recent calm shattered amid the deepening crisis in Washington. Wall Street is finally taking notice as the turmoil surrounding Trump threatens to derail the policy agenda that helped push global equities to records as recently as Tuesday. Many of the trades sparked by the president’s shock November election have reversed in recent days, with the dollar erasing its post-election rally.

“Political uncertainty is something that’s likely going to be with us for a significant amount of time,” said Dennis Debusschere, Evercore ISI’s head of portfolio strategy and quant. “We may be looking at a higher volatility backdrop with a trending lower market for the next couple of months.”

The administration is facing scrutiny about whether the president asked the former head of the FBI to drop an investigation, as well as questions about his handling of secret intelligence. The Justice Department named a special counsel to oversee the FBI’s investigation of Russia’s efforts to influence the 2016 election.

What’s ahead for investors:

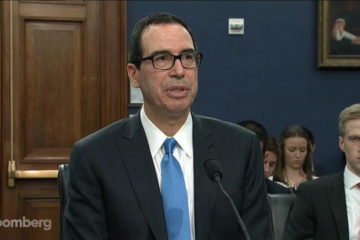

Data from Japan on Thursday will likely show the economy accelerated in the first three months of the year, posting a fifth straight quarter of expansion. That would be the longest consecutive period of growth since 2005-2006. Australia’s jobless rate is also in the spotlight. Unemployment probably remained at 5.9% last month, economists predict, with just 5,000 jobs added after March’s jump of almost 61,000. Other economic reports Thursday include China property prices, U.K. retail sales and GDP from the Philippines. Indonesia’s central bank comes out with a rates decision. Federal Reserve Bank of Cleveland President Loretta Mester speaks on the economy and monetary policy in the U.S. Odds of a June Fed rate hike settled around 60 percent, while full pricing of a next hike shifted to November from September, per Fed-dated OIS rates. U.S. Treasury Secretary Steven Mnuchin offers his first congressional testimony since taking office, appearing before the Senate Banking Committee on issues ranging from the rollback of Dodd-Frank financial regulations to his decision not to name China a currency manipulator.Here are the major moves in the markets:

Stocks

Futures on the Nikkei 225 Stock Average were down 1.5 percent in Singapore. Contracts on Australia’s S&P/ASX 200 Index and South Korea’s Kospi Index were off 1.1 percent. Hang Seng Index futures were 0.6 percent lower, and FTSE China A50 futures were down 0.4 percent. The S&P 500 fell 1.8 percent, its worst day since Sept. 9. The measure touched an all-time high Tuesday. The Dow average lost 372.82 points, while the Nasdaq Composite Index plunged 2.6 percent for its steepest drop since June 24. The MSCI All-Country World Index lost 1.2 percent from a record, with banks having the biggest impact across all regions. It was the worst day in eight months. MSCI’s emerging-market index retreated for the first time in eight sessions, sliding 0.6 percent. The Stoxx Europe 600 Index fell 1.2 percent.Currencies

The yen fell 0.2 percent to 110.99 as of 8:24 a.m. in Tokyo. The currency surged 2.1 percent, the most since November, on Wednesday. The Bloomberg Dollar Spot Index was slightly higher after dropping 0.5 percent on Wednesday to the lowest level since Nov. 8. The euro was flat at $1.1155, after four straight days of gains.Bonds

The yield on 10-year Treasuries dropped 10 basis points on Wednesday to 2.23 percent, the lowest since April 19.Commodities

Gold was steady at $1,260.66 an ounce, after climbing for five straight days to the highest level since the end of April. Crude was little changed at $49.09 a barrel, after jumping 0.8 percent in the previous session. Markets are getting some encouragement from the U.S. as supplies fell for a sixth week — a sign that OPEC-led production curbs are starting to be felt in the world’s biggest oil-consuming nation.

No Comment