A Trump Border Adjustment Tax Is a Wild Card for Oil: Gadfly

(Bloomberg Gadfly) —It’s only fair to warn you that this column concerns tax policy, so maybe grab a coffee first. It’s also about oil (if that helps.)

One of the incoming Trump administration’s priorities is tax reform. And one proposal outlined in Speaker Paul Ryan’s “Tax Reform Task Force Blueprint” with big implications for oil involves a so-called border adjustment tax. This would effectively tax U.S. businesses on their imports while offering a break on domestically produced goods for export. In other words, it is designed to encourage making stuff in the U.S. rather than buying it from overseas.

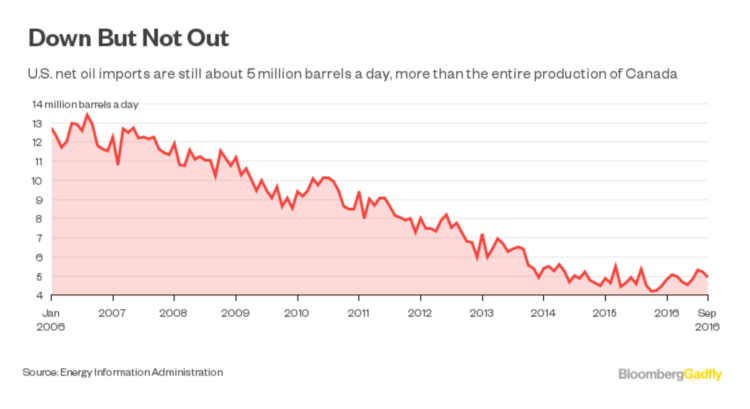

This matters for global oil markets because, even though the U.S. is less dependent on foreign barrels than it was a decade ago, it is still a big part of global oil trading.

A recent paper by Philip Verleger and the Brattle Group explains in some detail how a border-tax adjustment could affect energy markets (here’s a link). Here are some examples showing how it might work in practice:

U.S. oil producer: Say you pump oil in Texas. In simple terms, if you sold it to a domestic refiner for $52 a barrel (roughly where WTI crude oil trades now) you would pay 20 percent in tax on that revenue, or $10.40. On the other hand, if you exported it to a foreign buyer, you would pay no tax. Ergo, you would rather export it and would demand domestic refiners pay you a higher price to offset the tax hit — in this case, $65. U.S. oil refiner: Conversely, the new tax would, all else equal, encourage refiners to buy domestic oil. Say you buy crude at $52 a barrel and process it into fuels worth $70. If you bought the crude overseas, then you couldn’t deduct that cost for tax purposes, so you would pay 20 percent on the entire $70, or $14, in tax, leaving a net profit of $4 ($70 less $52 of crude costs less $14 of tax). Conversely, even if you paid $65 for domestic crude, you could deduct that expense. So the government would only take 20 percent of your net profit of $5, or $1 — leaving you with $4.This is very simplistic, but one potential outcome is that domestic fuel prices could rise as refiners and wholesalers pass on their increased costs. Verleger estimates that, at $50 Brent crude and a 20 percent tax, the border adjustment could add 30 cents to a gallon of gasoline.

How Much a Border Adjustment Tax Could Add To Gas Prices: 30 Cents A Gallon

If it sounds weird that any Republican government might promulgate a policy potentially raising pump prices, then you haven’t been paying attention. As recently as September, Harold Hamm, CEO of Continental Resources and adviser to president-elect Donald Trump, was calling for OPEC — an international cartel, mind — to do its part to raise oil prices (he got his wish).

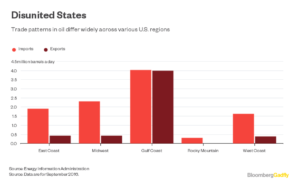

While the border adjustment is potentially a boon to domestic E&P companies, some refiners look more exposed to it than others. The U.S. isn’t a unified oil market but a set of regional ones. Refiners with a lot of capacity on the Gulf Coast would enjoy the flexibility to export their products — thereby avoiding the tax if they process domestic crude — but those on the East and West Coasts depend much more on imports.

None of this would happen in isolation, though, and this presents perhaps the biggest risk to the global oil market.

Go back to that premium U.S. oil producers could command. If rigs are being put back to work with oil in the low $50s, what do you think would happen if frackers could suddenly demand an extra 25 percent? That could complicate OPEC’s efforts in trying to support prices high enough for their members’ needs without priming shale output too much.

The more pernicious impact, though, could involve the dollar.

By raising demand for more competitive U.S. exports, the new tax ought to serve to strengthen the dollar. This ultimately negates some of the potential effects outlined above because a stronger dollar will tend to make exports less competitive (and imports cheaper) and suppress commodity prices in general.

It would, however, put further pressure on emerging economies, for whom dollar-denominated debt would become more expensive.

As fellow Gadfly Lisa Abramowicz pointed out recently, non-bank borrowers in emerging markets owe more than $3 trillion of dollar-denominated debt. And as I pointed out earlier this year, a lot of those borrowers are oil producers for whom rising debt costs provide an incentive to maximize output to pay their interest charges. Plus, of course, emerging economies are the engine of oil demand.

Entering 2017, the oil market is focused on the actions of Saudi Arabia, Russia and other producers. That shouldn’t blind it to the potential for another state actor to upend things.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

No Comment