There’s a New Normal in China’s Debt Market

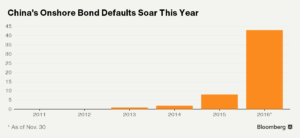

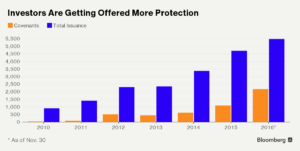

(Bloomberg) —What was once almost unheard of is becoming de rigueur in China’s corporate bond market.The amount of bonds sold by Chinese companies that come with certain investor protections is rapidly increasing. The ratio of debt wrapped with such covenants — which can help insulate bond buyers from certain corporate actions or by limiting the amount of borrowing a company is allowed to undertake — has risen to 40 percent of new deals sold as of Nov. 30 this year, up from 18 percent in 2014, according to data compiled by Bloomberg. The jump in covenants, including protections against change of control, collective action clauses, limits on indebtedness and dividend payouts, as well as ratings triggers, may be one indication that investors are pushing back against riskier deals as defaults in China’s corporate bond market rise.

Indeed, there are two factors at play in the new dynamic, says He Xuanlai, Singapore-based credit analyst at Commerzbank AG.

“One is investors trying to protect themselves from higher debt levels or other tricky issues because corporate governance has been a problem,” He said in an interview. “Second is [that] due to weaker balance sheet quality of the non-financial borrowers, issuers were forced to provide more protection for investors.”

While market analysts reckon that incorporating covenants could be a positive development for the country’s relatively nascent local bond market, bringing it more in-line with international peers, the ratio of investor protections has actually been on the decline in China’s market for offshore bonds.

“With Chinese high-yield corporate dollar-denominated bonds — both outstanding and new issuance — we have clearly seen covenants becoming looser to allow companies to add more debt,” said Raymond Chia, head of credit research for Asia ex-Japan at Schroder Investment Management Ltd. in Singapore.

“Bankers and issuers are giving investors a short-term incentive in return for longer-term pain, which could potentially cost investors a lot more,” he added. “There’s definitely a need for tighter language in place, be it a tighter incurrence ratio, such as higher fixed charge coverage ratio, or lower carve-outs.”

No Comment