This Year’s Crop of Tech IPOs Stunts the Next One: Gadfly

(Bloomberg Gadfly) —There has been a welcome trickle of technology companies going public in the last few months. It seemed to signal an end to the IPO desert of 2015 and most of 2016. The relatively strong — maybe too strong — recent public market debuts of tech companies such as Twilio Inc. and Nutanix Inc. helped support predictions of a surge of technology IPOs in 2017.

But in the last six weeks or so, the class of 2016 tech IPOs suddenly doesn’t look so hot. It’s far from a disaster, but fading share performances for some of the recent debutantes aren’t a great setup for the incoming IPO class, headlined by the likely public market listing of Snapchat parent company Snap Inc.

The good news is there have been more listings since the summer after a dry spell for most of 2016 for IPOs in general and tech listings in particular. And the stock market newcomers didn’t fall on their faces. Of the 18 tech IPOs in the U.S. this year, two-thirds are trading higher than their initial sale price, according to data compiled by Bloomberg. That is the kind of good early start that eluded the much larger crop of tech IPOs in the last few years, whose struggles sapped investors’ appetite for new tech listings.

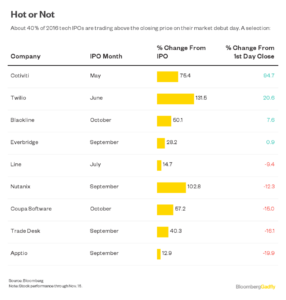

But all is not rosy. Only about 40 percent of this year’s tech IPOs are trading above the closing share price on their first day of trading. That metric matters because the first day of trading is the point at which all but the biggest institutional investors can buy shares of a newly public company.

The IPO darling of the year, Twilio, had dipped nearly back to where it closed on its first market day before shares recovered in the last few sessions. (Twilio’s stock price remains more than double the level at which it first sold shares.) Other harbingers of an IPO recovery — The Trade Desk Inc., Apptio Inc., Nutanix and Coupa Software Inc. — all had no trouble selling their IPO shares and had strong early stretches of trading. Now they are all below their closing prices on their first days as public companies.

There are good reasons for some stock sagging among recently public tech companies. Some of them have offered more stock to the public, and the increased supply naturally affects share demand. Investors might be cashing in some gains as the overall market for tech stocks has been bumpy both before and especially after the U.S. election. And in no rational market should Twilio’s enterprise value be 19 times its expected sales for the next 12 months, as it was in September — the second-most-highly valued U.S. technology company by that measure. Twilio’s multiple is now a still aggressive but more sane 8.7 times its estimated revenue.

The market-setting institutional shareholders who buy IPO shares have done well with this year’s new tech listings, and by all accounts they remain eager to invest in strong technology listings.

Companies are planning to give them what they want. Investment bank Union Square Advisors estimates as many as 90 tech companies are in the IPO queue, counting companies that have filed IPO paperwork plus others that have stated a desire to go public. Morgan Stanley’s top tech banker figured there might be 30 to 40 tech IPOs next year — more in line with the number of tech initial public offerings in 2014.

For sure the tech IPO market is in better shape than it has been for a couple of years. The companies going public are of higher quality than those with IPOs in 2014 and 2015, and valuations are less aggressive. That is a healthy backdrop for next year’s potential stock market debuts. But the cracks emerging in this year’s new tech listings don’t make a perfect setup for the IPO class of 2017.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

To contact the author of this story: Shira Ovide in New York at sovide@bloomberg.net To contact the editor responsible for this story: Daniel Niemi at dniemi1@bloomberg.net

No Comment