Tesla Sees SolarCity Boost Within 3 Years as Musk Hits Critics

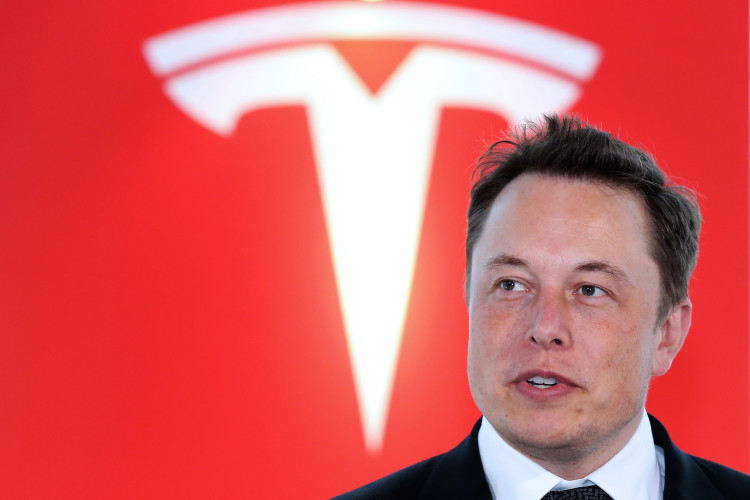

(Bloomberg) —Tesla Motors Inc. Chief Executive Officer Elon Musk took his skeptics to task on Tuesday, giving more detail on potential benefits of the automaker’s pending SolarCity Corp. acquisition and saying the deal’s doubters have a history of making bad predictions.

While people once questioned the company’s ability to make electric cars, the surge of interest in the forthcoming Model 3 means “no one should doubt that anymore,” Tesla said in a blog post after the market close on Tuesday. “Those same naysayers may have similar feelings about solar and storage, but it probably would be unwise to trust them again.”

SolarCity will add $1 billion in revenue to the combined company in 2017 and $500 million in cash to Tesla’s balance sheet over the next three years, Tesla predicted. Musk sees the merger as creating the world’s only integrated sustainable energy company, with consumers able to buy stylish electric cars, solar roofs and home batteries in a seamless transaction.

“Quite a few naysayers from big hedge funds” have been wrong in the past with a “batting average of zero,” Musk said on a later conference call with analysts, while mentioning no one by name.

The electric car and battery maker’s all-stock offer for SolarCity, now valued at about $2.1 billion, would unite two deeply intertwined companies. Musk is SolarCity’s chairman and largest financier, and the two boards have overlaps. Investors including the CtW Group have called for more independent directors to be added to the combined company if shareholders approve the merger in Nov. 17 votes. Short seller Jim Chanos has been among critics of the deal, calling the proposed merger “baffling” and a “walking insolvency.”

Tesla fell 1 percent to $188.82 shortly after 7 p.m. in New York. SolarCity was little changed at $19.06 a share. The premium that SolarCity shareholders might have expected when the offer was announced in June has disappeared.

SolarCity Earnings

Musk and his cousins, Lyndon and Peter Rive, formed the idea for SolarCity during a trip to the Burning Man arts festival in the Nevada desert more than a decade ago. Lyndon Rive is the solar company’s CEO.

Tesla said SolarCity boosted its cash in the third quarter from the previous three months and expects to increase it further during the current quarter. The San Mateo, California-based solar panel installer will release its third-quarter earnings report on Nov. 9, Lyndon Rive said on the conference call.

The combined company also lowers the risk at Tesla’s massive battery factory, which is currently being built near Reno, Nevada, the automaker said. “By pairing storage with solar, we can capture a market for our batteries that goes way beyond the market for our cars, thus maximizing the scale and potential of the Gigafactory,” Tesla said in today’s blog post.

Integrated Products

Musk revealed a new, integrated solar roof product at an event in Los Angeles on Friday. He seeks to pair SolarCity’s network of installers with Tesla’s formidable brand and retail footprint to give customers one-stop shopping for their clean energy needs, including homeowners who have expressed interest in solar but need to replace their roofs as well.

The glass roof shingle will combine technology from both Silevo, which SolarCity acquired, and Panasonic Corp., which has agreed to manufacture them at SolarCity’s factory in Buffalo, New York. Musk also revealed that Tesla, which has hired several materials scientists, has created a “Tesla Glass Unit.”

“With these products, our customers will have an entire sustainable energy ecosystem, comprised of products whose benefits go far beyond simply being sustainable,” Tesla said Tuesday. “They will be products that like Model S and Model X, you want to show your friends and family because they are so much better than anything you ever had before.”

Financing Change

SolarCity, which hasn’t made an annual profit in years, piled up $3.35 billion in debt at the start of the third quarter by investing in rooftop solar panels that the customers pay for over decades. Investors soured on the business model in the wake of SunEdison Inc.’s bankruptcy at the same time that growth began to slow in the U.S.

SolarCity shifted to offering a new loan program this year that uses outside financing and allows them to record revenue when each rooftop installation is completed. The loan program made up 30 percent of the company’s revenue in September.

Tesla’s ambitions to move beyond clean transportation to clean energy are driven, in part, by the urgency of climate change, with carbon dioxide levels exceeding predictions and NASA reporting that 2016 is all but certain to be the warmest year on record.

Tesla also said that it has no immediate need to raise cash. The automaker last week reported a third-quarter profit, its first in eight quarters.

“In terms of future equity or debt offerings, we always monitor the market and the macroeconomic situation to determine whether it’s appropriate to de-risk the business by having even greater capital reserves,” Tesla wrote. “However, given our recent execution and our future production targets, there is no economic need to raise more capital now.”

No Comment