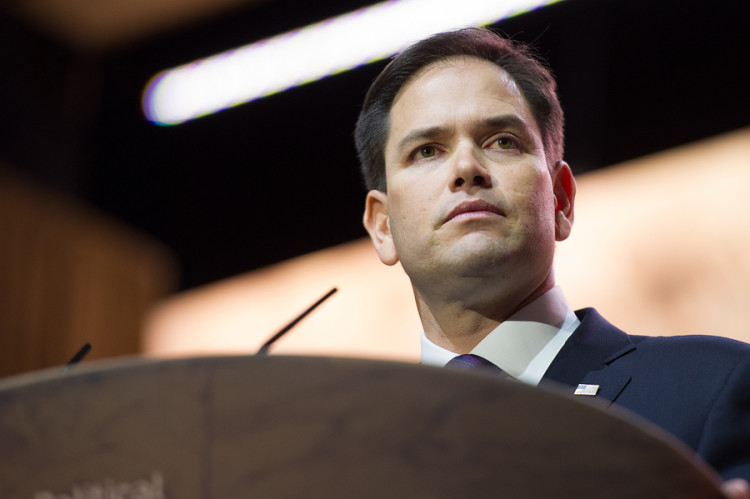

Rubio’s Tax Proposals Seen Risking ‘Unsustainable’ Deficits

©2016 Bloomberg News

O2E9TN6TTDSG

(Bloomberg) — While presidential candidate Marco Rubio’s tax proposals would put more money in taxpayer wallets and business coffers, their benefits would be concentrated at the top end of the income scale, and they could produce large, “unsustainable, budget deficits,” according to a policy group’s analysis.

The Republican contender’s proposals, which include eliminating taxes on capital gains and reducing the top corporate and individual tax rates, would reduce federal revenue by $6.8 trillion over the next 10 years, according to a report by the Tax Policy Center. The center is a joint project between two Washington nonprofit research groups, the Urban Institute and the Brookings Institution.

The tax cuts would spur savings and investment and might fuel economic growth, but only if interest rates don’t rise and unprecedented spending cuts are enacted, said Len Burman, the center’s director.

“Marco is proud that his plan cuts taxes for working families, boosts wages for everyone, creates millions of jobs, and increases incentives for work and investment,” said Alex Conant, a spokesman for the Florida senator, in an email. “Of course a left-wing think tank that has been called ‘the intellectual frontmen for President Obama’s re-election campaign’ is misrepresenting Marco’s pro-growth, pro-family tax plan. Any analysis that does not account for the positive economic impact of pro-growth tax reform is worthless.”

The tax policy center’s findings land in the middle of two previous analyses. One, by Citizens for Tax Justice, estimated Rubio’s tax cuts would cost $11.8 trillion over a decade; the other, by the Tax Foundation, estimated that cost at $4.1 trillion. The new analysis applied methodology similar to that used by the congressional Joint Committee on Taxation, according to the report — though not all of Rubio’s proposals have been spelled out fully and the campaign didn’t respond to the center’s request for additional details.

Capital Gains

Rubio’s plan would scrap the long-term capital gains tax on investment profit, eliminate estate and gift taxes and reduce the existing seven individual tax brackets to three. The top rate would be 35 percent, down from the current 39.6 percent.

By eliminating taxes on investment and savings income, Rubio’s proposal would effectively transform the individual income-tax system into a consumption-tax system, the report said.

In a similar fashion, the plan would allow businesses — from publicly traded corporations to partnerships and other pass-throughs — to immediately deduct their spending on investments, while eliminating taxes on interest received and deductions on interest paid. The top corporate tax rate would be 25 percent, down from 35 percent today.

Rubio’s plan to move to a territorial system would eliminate corporate taxes on income earned overseas — and he proposes a 6 percent “deemed repatriation” tax on some $2.1 trillion in earnings on which U.S. companies have deferred taxes so far. The repatriation tax would be payable over 10 years.

In general, Rubio’s plans would help discourage so-called corporate inversions, in which companies merge with foreign firms to move their tax addresses overseas and reduce their tax burdens, the analysis found. However, the plan might encourage businesses to try to re-characterize their domestic income as lower-tax foreign income, the report said.

Benefit the Wealthy

Taken as a whole, Rubio’s proposals for changing the individual income tax would benefit top earners the most by far, according to the analysis. The top 0.1 percent of taxpayers, or those with incomes over $3.7 million, would see an average tax cut of about $930,000, representing 13.6 percent of their after- tax income. Households in the middle fifth of the income distribution would see an average tax cut of almost $1,400, or 2.5 percent of after-tax income, while the poorest fifth of households would see their taxes go down an average of about $250, boosting their after-tax income by 1.9 percent.

Rubio proposes to scrap the 3.8 percent surcharge on investment income that high-earning Americans pay under Obamacare. The surcharge has taken the current top capital gains rate to 28.3 percent. His plan would scrap almost all itemized deductions, except for those relating to mortgage-interest payments and charitable contributions.

Rubio calls for a one-time transition tax on unrealized capital gains. TPC said it was unclear whether Rubio’s plan would eliminate taxes on other types of investments, including short-term capital gains, non-stock assets, nonqualified dividends and some interest income.

Burman called Rubio’s plan “pro-family” because it creates a child tax credit of as much as $2,500 per child that would reach single taxpayers with incomes up to $200,000 and joint filers up to $400,000. It also provides an expanded Family Medical Leave Act credit.

Another Rubio proposal, to eliminate federal estate and gift taxes, “raises the risk that the resulting large concentrations of wealth would convey undue economic and political power,” the analysis said.

To contact the reporter on this story: Lynnley Browning in New York at lbrowning4@bloomberg.net To contact the editors responsible for this story: John Voskuhl at jvoskuhl@bloomberg.net Alex Wayne

No Comment