Pound Drops as U.K. Exit Poll Unnerves Investors: Markets Wrap

Sterling dropped 1.6 percent after the ruling Conservative Party was projected to win most seats, though fall short of an overall majority. The yen and gold fluctuated while Treasuries edged higher. S&P 500 Index futures declined and Asian equities were mixed.

Investors are facing the prospect of another round of political turmoil less than a year after Britain voted to leave the European Union. While May could still win a majority, attention will turn to her future after the decision to call an early election and strengthen her mandate backfired. She will now need to decide whether to resign or try to form a new government. Another election is also a possibility.

“The initial exit poll suggests it’s been a catastrophic campaign for Theresa May,” said Craig Erlam, London-based senior market analyst at OANDA Corp. “A hung parliament is the worst outcome from a markets perspective as it creates another layer of uncertainty ahead of the Brexit negotiations and chips away at what is already a short timeline to secure a deal for Britain.” Read our TOPLive blog coverage of the election here.

The election results cap a day of major events that have riveted investors all week. U.S. stocks ended Thursday’s session little changed, while Treasuries fell as the European Central Bank policy decision and testimony from former FBI Director James Comey did little to impact financial markets.

Here are the main moves in markets:

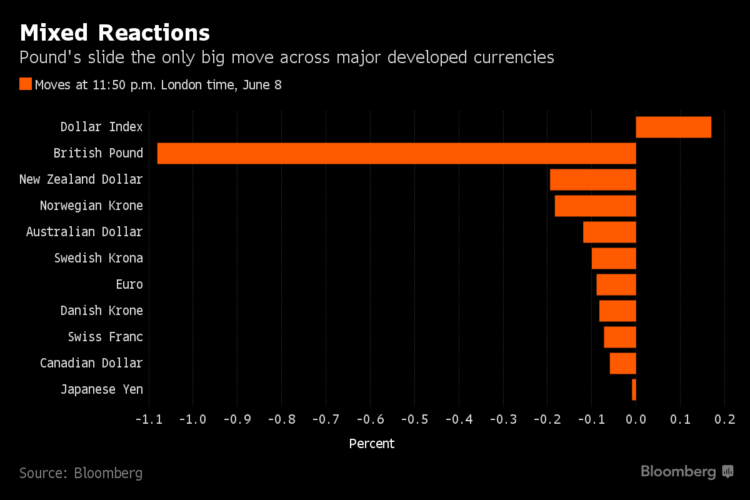

Currencies

The pound lost 1.6 percent to $1.2745 as of 9:12 a.m. in Tokyo. The yen was little changed at 110 per dollar. The euro fell 0.2 percent to $1.1191. The Bloomberg Dollar Spot Index added 0.3 percent, gaining for a third day.Stocks

Futures on the S&P 500 sank 0.2 percent. The underlying gauge rose less than one point to 2,433.78 on Thursday, for a second day of gains. It briefly rose above its closing record during Comey’s testimony but faded in afternoon trading. Banks led gains for a second day, while energy shares slid. Rate-sensitive shares fell the most. Futures on the FTSE 100 Index fell 0.3 percent. The Stoxx Europe 600 Index edged lower on Thursday. Japan’s Topix index was little changed, while Australia’s S&P/ASX 200 Index fell 0.2 percent. South Korea’s Kospi index added 0.4 percent.Bonds

The yield on 10-year Treasuries fell two basis points to 2.17 percent. Benchmark U.K. gilt yields rose three basis points to 1.03 percent on Thursday, underperforming European peers. German bund yields fell one basis point to 0.25 percent.Commodities

Oil lost 0.3 percent to $45.50 a barrel, after touching the lowest level in five weeks after an unexpected increase in U.S. crude stockpiles cast doubt on OPEC’s ability to rebalance world crude markets. Gold rose 0.1 percent to $1,279.32 an ounce, after a 0.7 percent drop on Thursday. Rubber capped its longest run of losses in at least 42 years, dropping to a seven-month low on concern that a shaky Chinese economy may slow demand just as supply picks up.< --With assistance from Garfield Reynolds.To contact the reporters on this story: Jeremy Herron in New York at jherron8@bloomberg.net ;Adam Haigh in Sydney at ahaigh1@bloomberg.net To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net Jeff Sutherland copyright © 2017 Bloomberg L.P

No Comment