Goldman Sachs

Matt Levine’s Money Stuff: Investing Stores and Libyan Bribes

published May 4th 2017, 8:31 am (Bloomberg View) — Morgan Stanley vs. Vanguard. Morgan Stanley runs investing stores across the country, and if you walk into their investing stores you will see investments on the shelves. You’ll browse around, pick out some investments that you like, maybe ask a sales associate

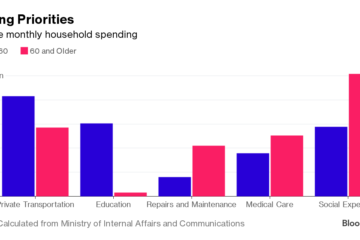

Seniors Driving Consumption Growth as Japan Ages

published Dec 4th 2016, 3:00 pm, by Connor Cislo (Bloomberg) — As much of working-age Japan frets about having enough money in old age, the nation’s seniors are increasingly propping up consumer spending, accounting for the little growth in consumption the country has seen in recent years. It is something

Matt Levine’s Money Stuff: Illegal Stock Tips and Risky Loans

published Oct 5th 2016, 8:17 am, by Matt Levine (Bloomberg View) — Insider trading. I don’t know what else there is to say about the Salman insider trading case being argued before the Supreme Court today, but I guess Salman’s and the government’s lawyers will find something. If you pass inside

Google Must Prove It’s Making Headway in the Cloud: Gadfly

published Sep 29th 2016, 1:21 pm, by Shira Ovide (Bloomberg Gadfly) — If horror-film villain Freddy Krueger had threatened terror for nine movies but never followed through with evil acts, eventually movie-goers would have stopped being scared of him. Google is at risk of becoming that neutered Freddy Krueger. For

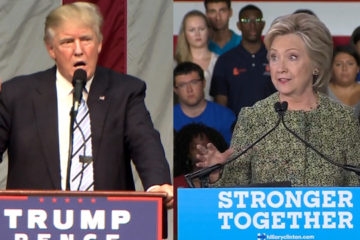

How to Play the Debate: A Personal-Finance Guide

published Sep 26th 2016, 6:17 am, by Suzanne Woolley (Bloomberg) — Listen closely tonight. It’s your money and your life. At 9 p.m. ET, in the first presidential debate of the season, Hillary Clinton and Donald Trump will be pressed, to a degree, for details of their various proposals. Jobs,

Banks’ Commodity Woes Deepen as Energy and Metals Earnings Hit

published Sep 5th 2016, 6:01 pm, by Agnieszka de Sousa (Bloomberg) — It’s looking like another bad year for the biggest banks when it comes to commodities. Revenue from raw materials at Goldman Sachs Group Inc., JPMorgan Chase & Co. and 10 other top banks slid 25 percent in the

Five Things You Need to Know to Start Your Day

published Jul 19th 2016, 5:56 am, by Lorcan Roche Kelly (Bloomberg) — We’re searching for Brexit impact, Goldman earnings are due, and Turkey may be cut to junk. Here are some of the things people in markets are talking about today. Brexit effects All eyes remain on U.K. economic data

‘He’s a Nasty Guy’: Trump Goes Off No Holds Barred on Cruz

©2016 Bloomberg News O14CGS6JIJUO (Bloomberg) — A rolling brawl between the two U.S. Republican presidential front-runners didn’t abate on Sunday as Donald Trump termed his closest competitor, Ted Cruz, “nasty” and the Texas senator stood his ground in criticizing the billionaire’s “New York values.” “He’s a nasty guy,” Trump said on

Matt Levine’s Money Stuff: Big Banks, Big Bonds and Big Jackpots

©2016 Bloomberg View O0Y3V76KLVR7 JPMorgan JPMorgan tweeted its earnings this morning. They were good, at $1.32 per share, up quarter-on-quarter but down year-on-year, and “much of the improvement in profit came from continuing cuts to the bank’s expenses and work force.” Here are the press release, thepresentation and the financial supplement. Elsewhere in big

Long Bonds Punish Investors as Goldman Sachs Sees Poor Outlook

©2015 Bloomberg News NO7QKB6JIJUR (Bloomberg) — Last year’s superstar of the Treasury market is punishing investors in 2015, and Goldman Sachs Group Inc. is calling it a “poor investment.” Thirty-year bonds have slumped 8 percent in the past two weeks, leaving investors with a loss of 4.8 percent since Dec. 31,