Your Money

Articles to keep you informed about trends and help you manage your money

Matt Levine’s Money Stuff: VIX Hedging and College Sports

published May 26th 2017, 8:48 am, by Matt Levine (Bloomberg View) — VIX manipulation We talked on Wednesday about the CBOE Volatility Index, the VIX, which is an index of implied volatility based on S&P 500 Index stock options. The VIX is used as the reference for VIX futures and

The ‘Below Average’ Fund Fee Could Eat Your Retirement

published May 24th 2017, 8:45 am, by Suzanne Woolley (Bloomberg) —Average fees paid for U.S. mutual funds and exchange-traded funds fell to a new low of less than 0.6 percent in 2016, Morningstar reported on Tuesday. That’s good news for investors. But as fund companies drive down those expense ratios in a fight

Matt Levine’s Money Stuff: Relationships and Glass-Steagall

published May 19th 2017, 8:32 am, by Matt Levine (Bloomberg View) —MiFID II. One thing that I like to say around here is that a lot of the financial industry is run as essentially a gift economy. Investment bankers don’t just do stuff for clients and send them the bill:

Graduation Gifts That Pay for Themselves

published May 17th 2017, 10:31 am, by Suzanne Woolley (Bloomberg) —With graduation gifts, it’s the thought that counts. The cash is nice, too. Spending on graduation gifts in the U.S. is expected to reach $5.6 billion this year, according to a new survey from the National Retail Federation. That tops last

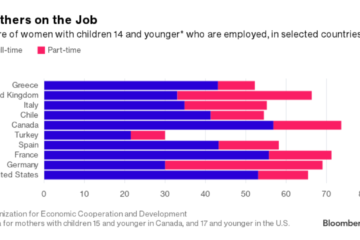

Modern Motherhood Has Economists Worried

published May 12th 2017, 7:57 am, by Ben Steverman (Bloomberg) —Motherhood is changing, as are mothers’ working lives—and those changes have economists concerned. For a while, women around the world were making clear economic progress. More of them were working, and they were earning more (and boosting the global economy in the process).

You’re Killing It With Your 401(k)—on Autopilot

published May 12th 2017, 7:30 am, by Suzanne Woolley (Bloomberg) —Automation, that demon of American job security, may be the patron saint of retirement savings. The average balance in a 401(k) defined-contribution account at Fidelity Investments hit a record $95,500 in the first quarter, up more than 9 percent from a

Booming Growth Stocks and the Bear Case on the U.S. Economy

published May 11th 2017, 9:35 am, by Lu Wang (Bloomberg) —Things are looking great for equities. Right? Before today’s plunge, hardly a day went by without another record. The S&P 500 Index has closed at an all-time high 16 times in 2017, its 7 percent advance through Wednesday led by

Washington Is Making It Tougher to Retire

published May 4th 2017, 4:00 pm, by Ben Steverman (Bloomberg) —Americans face two big problems as they get older: a shortage of retirement savings and the skyrocketing cost of health care. Both may be about to get worse after two narrow votes in Congress this week. On Wednesday, the Senate voted

What Is Washington Doing to My 401(k) Tax Break?

published May 3rd 2017, 8:45 am, by Suzanne Woolley (Bloomberg) —Twitter had a brief freakout last week after White House spokesman Sean Spicer seemed to suggest that pretax 401(k) contributions to retirement savings were in danger. The White House hastened to say that wasn’t part of the proposed tax overhaul

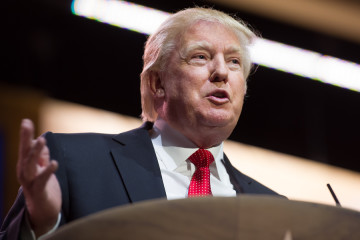

What Trump Has Done for (and to) Your Finances

published Apr 28th 2017, 4:00 am, by Suzanne Woolley (Bloomberg) — The long-term impact of a new presidential administration’s early acts is almost impossible to assess. That hasn’t stopped some from making weighty pronouncements on Donald Trump’s first 100 days, including Donald Trump. And it won’t stop us. With that,