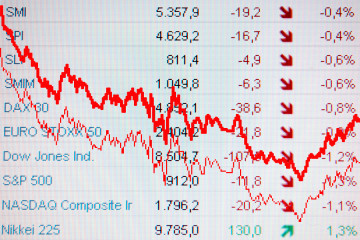

Asian Stocks Retreat Amid Earnings as Technology Shares Decline

(Bloomberg) —Asian stocks dropped as crude oil retreated and technology shares declined after Apple Inc. sank to the lowest since June 2014.

The MSCI Asia Pacific Index slipped 0.2 percent to 127.26 as of 9:06 a.m. in Tokyo. The gauge pared this week’s advance to 0.1 percent. Bullish momentum in equities from a February low faltered over the past month, as signs of weakness in the global economy and disappointing corporate earnings heightened concerns over whether central bank officials will be able to effectively boost growth.

“After the rally in March and April, things are still looking a little bit uncertain,” Oliver Lee, investment director at Old Mutual Global Investors (Asia Pacific) Ltd., said. “There’s not much conviction in the market. The market is still being driven by central bank sentiment and currency movements. The earnings season in Japan hasn’t been great.”

Of the companies on Japan’s Topix index that have reported earnings since the beginning of April, about 62 percent missed analyst estimates for profit, according to data compiled by Bloomberg. Honda Motor Co. and Sumitomo Mitsui Financial Group Inc. are among Japanese companies scheduled to report results Friday.

The Topix added 0.1 percent. South Korea’s Kospi index climbed 0.1 percent. Australia’s S&P/ASX 200 Index was little changed. New Zealand’s S&P/NZX 50 Index declined 0.1 percent. Markets in China and Hong Kong have yet to start trading.

Futures on the FTSE China A50 Index dropped 0.2 percent in their most recent trading, while those for the Hang Seng Index slipped 0.3 percent. Most Chinese stocks fell Thursday, led by industrial and consumer-staples companies. The Shanghai Composite Index closed little changed.

Soured loans at Chinese commercial banks rose to the highest level in 11 years as defaults spread from small private firms to large state-owned enterprises in a weakening economy. Nonperforming loans rose 9 percent to 1.39 trillion yuan ($214 billion) in March from December, the fastest increase in three quarters, data from the China Banking Regulatory Commission showed Thursday.

Futures on the S&P 500 Index rose 0.1 percent. The U.S. equity benchmark index closed little changed in Thursday as a selloff in Apple was offset by gains in Monsanto Co.

Apple fell to a 22-month low after a report fueled speculation iPhone sales continue to slump. Monsanto jumped 8.4 percent as people familiar with the matter said Bayer AG is exploring a potential bid for its U.S. competitor.

West Texas Intermediate crude fell as much as 0.9 percent in early Friday trading after climbing 1 percent in New York on Thursday.

No Comment