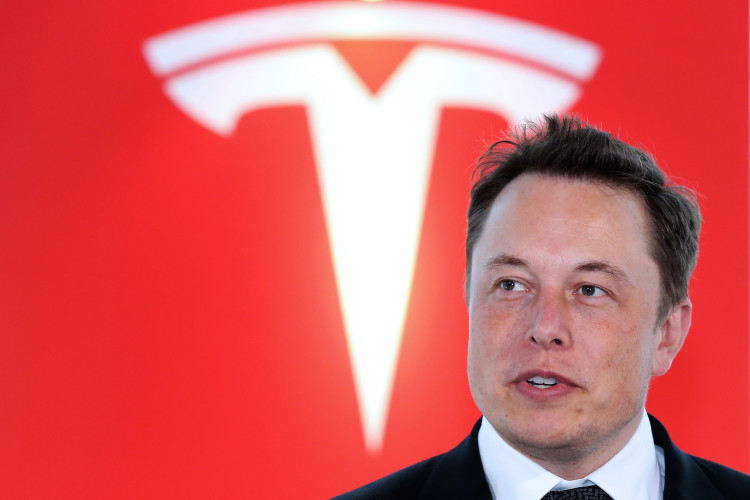

Musk Is Sued by SEC, Seeking a Ban, Over ‘Funding Secured’ Tweet

published Sep 27, 2018, 4:48:27 PM, by Matt Robinson

(Bloomberg) —

Elon Musk was accused by the Securities and Exchange Commission of misleading investors when he tweeted that he had funding lined up to take Tesla Inc. private.

The SEC’s allegation, contained in a lawsuit filed fewer than two months after the Tesla CEO’s tweet, sent the company’s shares down more than 11 percent in after-hours trading. It sought unspecified monetary penalties and added a market-rattling request — that a judge bar Musk from serving as an officer or director of a public company.

The SEC brought the case swiftly because its investigation was done — and impact would be greatest soon after the alleged misconduct, SEC co-enforcement director Steve Peikin said in a news conference.

That request could force Musk to step to the negotiating table quickly to reach a settlement, lest he leave investors wondering about the fate of a company whose image has become intertwined with that of its maverick CEO.

“It’s unusual for a case of this significance to move this quickly, in particular when you’ve got a high-profile individual,” said Robert Long, a former SEC enforcement attorney now in private practice at Bell Nunnally in Dallas. Still, because the investigation was narrowly focused on several tweets, he said the agency “could have conducted its investigation quickly.”

The agency said Musk fabricated the claim in his August tweet that he had “funding secured,” which immediately sent Tesla shares soaring. After calculating a price for taking the company private, the SEC said Musk rounded up to $420 — a reference to “marijuana culture” that, according to the agency, he used because he thought his girlfriend would find it humorous.

“In truth and in fact, Musk had not even discussed, much less confirmed, key deal terms, including price, with any potential funding source,” the SEC said in complaint filed Thursday in Manhattan federal court.

The company, which wasn’t sued, didn’t immediately respond to requests for comment.

“This unjustified action by the SEC leaves me deeply saddened and disappointed,” Musk said in a statement. “I have always taken action in the best interests of truth, transparency and investors. Integrity is the most important value in my life and the facts will show I never compromised this in any way.”

To read the complaint on the Bloomberg Terminal, click here

Even before the tweets, the SEC was investigating issues at Tesla including its car sales projections. In addition to the SEC suit, the Justice Department is also looking into whether Musk misled investors, Bloomberg News has reported.

On July 31, the SEC said in its complaint, Musk met with three members of a “sovereign wealth fund” at Tesla’s factory in Fremont, California, for approximately 30 to 45 minutes. In that meeting, a member of the fund expressed interest in taking Tesla private. Musk took that to mean he was proposing a “standard” going-private transaction, but the terms were not discussed.

Musk has previously said he was talking to Saudi investors about a plan to take the company private.

On Aug. 2, Musk sent an email to the company’s board of directors, chief financial officer and general counsel with a subject line of “Offer to Take Tesla Private at $420.” In the email, Musk explained he wanted to sidestep the “constant defamatory attacks by the short-selling community, resulting in great harm to our valuable brand.”

On Aug. 6, Musk discussed a potential takeover with an unnamed private equity executive who has experience with such transactions. That executive told Musk that such a deal was “unprecedented” in his experience.

The next day, Musk tweeted from his cell phone: “Am considering taking Tesla private at $420. Funding secured.” Shares rose 11 percent and trading volume spiked. About 12 minutes later, Tesla’s head of investor relations sent a text to Musk’s chief of staff asking, “Was this text legit?”

About 20 minutes later, the company’s chief financial officer texted Musk: “Elon, am sure you have thought about a broader communication on your rationale and structure to employees and potential investors. Would it help if [Tesla’s head of communications], [Tesla’s General Counsel], and I draft a blog post or employee email for you?”

Musk responded, “Yeah, that would be great.”

Tesla’s Chief Financial Officer then replied, “Working on it. Will send you shortly.”

Musk didn’t clarify his statement until an Aug. 13 blog post in which he tried to walk back the tweet. On Aug. 24, the company announced that it would not be pursuing a buyout.

“Musk made his false and misleading public statements about taking Tesla private using his mobile phone in the middle of the active trading day,” the SEC said. “He did not discuss the content of the statements with anyone else prior to publishing them to his over 22 million Twitter followers and anyone else with access to the Internet. He also did not inform Nasdaq that he intended to make this public announcement, as Nasdaq rules required.”

“Musk’s false and misleading statements and omissions caused significant confusion and disruption in the market for Tesla’s stock and resulting harm to investors,” the SEC said in its complaint.

Elon Musk @elonmusk Am considering taking Tesla private at $420. Funding secured.

Sent via Twitter for iPhone.

View original tweet.

–With assistance from Patricia Hurtado, Joshua Fineman, Tom Schoenberg, Jesse Hamilton, Jamie Butters and Dana Hull.To contact the reporter on this story: Matt Robinson in New York at mrobinson55@bloomberg.net To contact the editors responsible for this story: Jeffrey D Grocott at jgrocott2@bloomberg.net David Glovin

COPYRIGHT

© 2018 Bloomberg L.P

No Comment