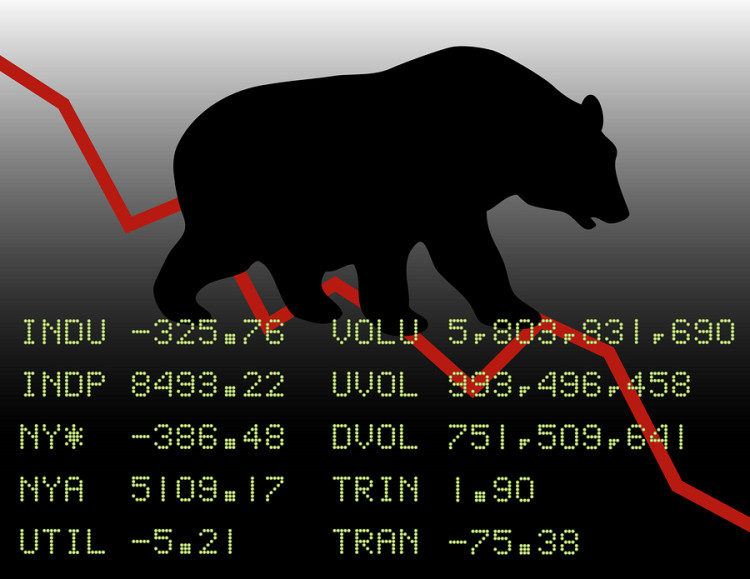

Copper Tumbles Into a Bear Market

published Aug 15, 2018, 6:00:00 PM, by Susanne Barton

(Bloomberg) —

Copper plunged into a bear market as concerns mount that Turkey’s financial crisis and the U.S.-China trade spat will stymie global economic growth.

The red metal for delivery in three months fell 4 percent to settle at $5,801 a metric ton at 5:52 p.m. Wednesday on the London Metal Exchange. That’s a more-than 20 percent drop from its high of $7,332 a ton in June, meeting the common definition of a bear market. Copper has posted four straight daily losses, dropping to the lowest in more than a year.

Losses on Wednesday were triggered by a broad retreat in China as the yuan weakened and recent data showed the economy hit a rough patch. The metal’s losses have accelerated as investors flee to the relative safety of the dollar amid Turkey’s financial woes and as concern grows that a U.S.-China trade spat will curb economic growth, hurting demand for raw materials.

“You had longs who were holding out ahead of the technical $6,000-a-ton pivot who ultimately liquidated,” Tai Wong, head of base and precious metals trading at BMO Capital Markets in New York, said by telephone. “Combine that with an unfriendly macro backdrop and a strong dollar without any apparent relief in sight, and you have a rout across the complex.”

Copper prices were also hit by easing supply concerns. BHP Billiton Ltd. and the union at the world’s biggest mine in Chile agreed to put a new wage offer to a vote by workers, potentially saving the industry from a strike that threatened to disrupt supply at a time of shrinking stockpiles.

Comex copper also fell into a bear market on Wednesday. Futures for September delivery declined 4.5 percent to settle at $2.56 a pound in New York. That’s a more-than 20 percent drop from a close of $3.30 a pound on June 8.

The London Metal Exchange LMEX Index of six metals slid 4 percent, the most in more than three years.

To contact the reporter on this story: Susanne Barton in New York at swalker33@bloomberg.net To contact the editors responsible for this story: James Attwood at jattwood3@bloomberg.net Joe Richter, Steven Frank

COPYRIGHT

© 2018 Bloomberg L.P

No Comment