Mortgage Insurance Program Knocked by GOP Slips But Doesn’t Fall

(Bloomberg) —

The financial health of a top U.S. mortgage program worsened this year, which could make it harder for affordable-housing advocates to persuade a key government agency to cut the fees it charges lower-income borrowers.

The capital reserves of the Federal Housing Administration fell by about $2 billion to $25.6 billion for the year ended in September, according to a U.S. Department of Housing and Urban Development report. The decline means the FHA is barely meeting the statutory minimum for money it must set aside to cover soured mortgages.

The FHA doesn’t make loans. It sells insurance, paid by borrowers, on mortgages that can have a down payment of as low as 3.5 percent and a credit score of 580. The program is commonly used by first-time home buyers and other borrowers with little wealth. Should borrowers fail to make their payments, the insurance makes lenders whole.

In January, President Barack Obama’s administration announced a reduction in FHA insurance premiums to try to make housing more affordable. But President Donald Trump’s administration stopped the cut’s implementation on his first day in office. Since then, some affordable-housing advocates, trade groups and Democratic lawmakers have called for it to be reinstated. Their effort could now be more challenging.

‘Constant Vigilance’

The FHA’s capital reserve fund is required by law to be at least 2 percent of the $1.23 trillion of mortgages it guarantees. At $25.6 billion, the fund now represents 2.09 percent of the loans back stopped by the agency, down from 2.35 percent in 2016. Had the Obama administration’s fee cut taken effect, the FHA’s capital reserves would have fallen to 1.76 percent, HUD said Wednesday.

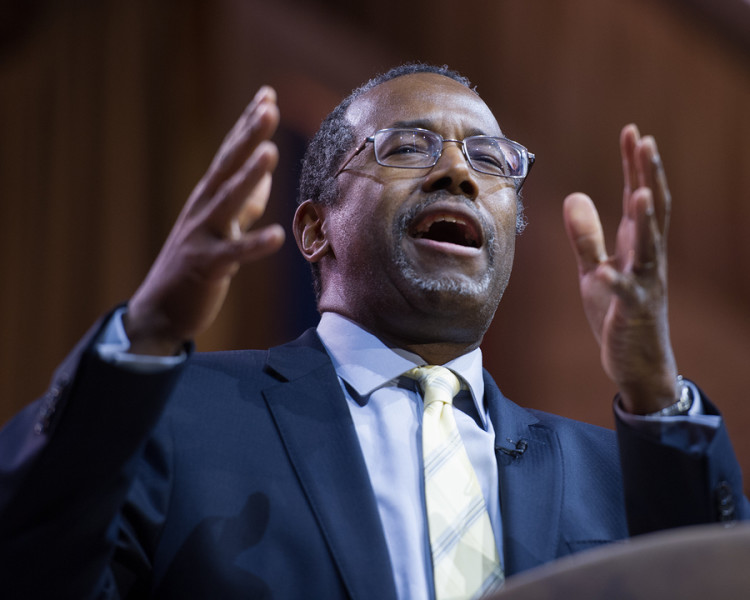

“The fiscal health of FHA demands our constant attention and vigilance to ensure we can continue providing sustainable homeownership opportunities to working families without exposing taxpayers to excessive risk,” HUD Secretary Ben Carson said in a statement.

Some Republicans have called on the Trump administration to rein in the FHA’s footprint through actions such as lowering the size of a mortgage it can guarantee. The FHA’s loan limit is $275,665 for single-unit homes in most of the U.S., but the agency can insure a mortgage of up to $636,150 in high-cost areas.

After the 2008 financial crisis, the FHA’s reserve fund ran dry, and the agency received a $1.7 billion bailout, its first in nearly 80 years. The fund has been above 2 percent since 2015.

Stemming Losses

HUD said this year’s decrease in reserves was driven by the FHA’s reverse-mortgage program. It lets seniors take out loans against their homes. HUD said it made changes to fees earlier this year in an attempt to stem losses. The initiative’s financial results tend to swing dramatically up and down from year to year depending on what interest rates are forecast to be.

On the other hand, the health of the FHA’s main program geared to first-time buyers continued to improve, according to HUD.

U.S. Treasury Secretary Steven Mnuchin said at a conference in Washington this week that the Trump administration will look at reforming the FHA in addition to other U.S.-backed mortgage entities, such as the government-sponsored enterprises Fannie Mae and Freddie Mac. When the FHA has raised its fees in the past, more borrowers have gotten loans backed by Fannie and Freddie.

“We want to make sure whatever we do with the GSEs we also look at FHA and we don’t push down the government risk in one area only to find out it grows in another area,” Mnuchin said.

No Comment