Starbucks’ New CEO Faces Early Challenge: Reigniting Sales

published Apr 27th 2017, 4:58 pm, by Leslie Patton

(Bloomberg) —

Starbucks Corp.’s new chief, who took the job this month, isn’t getting much of a honeymoon.

The shares declined as much as 5.9 percent in late trading Thursday after quarterly sales missed analysts’ estimates, renewing concerns that competition and mobile-ordering problems are weighing on growth.

Same-store sales — a key benchmark — rose 3 percent last quarter, the Seattle-based company said Thursday. Analysts polled by Consensus Metrix projected a 3.6 percent gain.

The results leave it up to Chief Executive Officer Kevin Johnson to reassure investors he has a plan for reigniting sales — especially as cheaper rivals target his company’s market share. McDonald’s Corp. has been advertising $1 and $2 drink specials this year, while the Dunkin’ Donuts loyalty program is drawing more converts.

“It seems likely slower sales growth in the U.S. may become the new norm,” said Jennifer Bartashus, an analyst at Bloomberg Intelligence. “There is an awful lot of competition out there.”

Starbucks also has suffered problems with its much-vaunted mobile-ordering technology. As more customers embrace the platform, it has caused traffic jams within cafes. Starbucks warned earlier this year that the problems were taking a toll on results.

“It isn’t that surprising that they were not able to solve mobile-related traffic issues in one quarter,” Bartashus said. “That type of operational analysis and change takes time.”

Stock Slips

Starbucks fell as low as $57.70 in late trading in New York after the results were posted. Through Thursday’s close, the shares had gained 10 percent this year, outpacing the 6.7 percent increase of the Standard & Poor’s 500 Index.

Revenue amounted to $5.3 billion in the fiscal second quarter, which ended April 2. That was short of the $5.42 billion projected by analysts. Excluding some items, profit was 45 cents a share. That matched analysts’ estimates.

Starbucks missed analysts’ projections in all its major geographic areas, including the China Asia-Pacific region that’s seen as key to its future. Same-store sales in that part of the world rose 3 percent last quarter, compared with a 4.7 percent estimate.

They also gained 3 percent in the Americas, missing the 3.5 percent projection. In Europe, the Middle East and Africa, the sales fell 1 percent. Analysts were looking for a 0.2 percent increase.

In a conference call with analysts, Starbucks said it can still meet its annual goal of comparative sales in the mid-single digits. Growth has begun accelerating in April, the company said. Earnings will be $2.08 to $2.12 this year, excluding some items, with revenue climbing 8 percent to 10 percent.

Starbucks also said sales at some of its Teavana mall-based shops are declining. It’s pursuing strategic options for some of those locations.

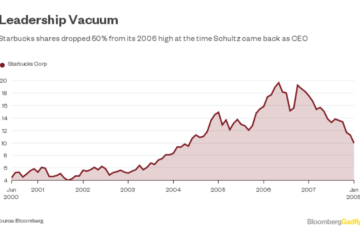

Johnson, a longtime technology executive, stepped into a CEO job that was held by Howard Schultz — the man responsible for building Starbucks into a household name. Though Schultz is staying on as chairman, providing continuity to the business, the leadership change has made investors nervous. When Johnson’s appointment was first announced last year, the news sent the stock tumbling.

Lunch Push

Domestically, Starbucks has been trying to improve its lunch selection. Earlier this month, the chain began offering a new line of sandwiches and salads, dubbed Mercato, at about 100 locations in Chicago. The grab-and-go fare is made fresh daily in outside kitchens.

Starbucks is accelerating plans to roll out new lunch items, the company said on Thursday.

But the mobile-ordering hiccups have hampered its efforts. It hasn’t yet been successful in fixing the snags, which cause congestion at the pickup counter, Chief Financial Officer Scott Maw said in an interview.

“It’s gotten a little bit better, but it’s still going on,” he said. To help streamline ordering, the company is retraining employees and adding touch-screen tablets. It’s also testing the idea of putting additional workers at some its busiest locations to improve order speeds, he said.

To contact the reporter on this story: Leslie Patton in Chicago at lpatton5@bloomberg.net To contact the editors responsible for this story: Nick Turner at nturner7@bloomberg.net Mark Schoifet

copyright

© 2017 Bloomberg L.P

No Comment