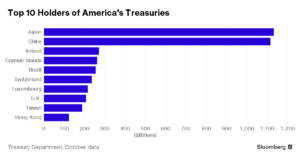

Japan Overtakes China as Largest Holder of U.S. Treasuries

published Dec 15th 2016, 4:23 pm, by Sarah McGregor

(Bloomberg) —

China’s holdings of U.S. Treasuries declined to the lowest in more than six years as the world’s second-largest economy uses its currency reserves to support the yuan. Japan overtook China as America’s top foreign creditor, as its holdings edged down at a slower pace.

A monthly Treasury Department report showed China held $1.12 trillion in U.S. government bonds, notes and bills in October, down $41.3 billion from the prior month and the lowest investment since July 2010. The portfolio of Japan decreased for third month, falling by $4.5 billion to $1.13 trillion, according to the data. Collectively, the two nations account for about 37 percent of America’s foreign debt holdings.

China’s foreign reserves, the world’s largest stockpile, declined for the fifth straight month in November to $3.05 trillion — the lowest since March 2011 — amid support for the sliding currency. That stockpile has fallen from a record $4 trillion in June 2015.

The report, which also contains data on international capital flows, showed net foreign buying of long-term securities totaling $9.4 billion in October.

International investors sold $63.5 billion in U.S. Treasuries in October, while foreigners purchased a net $4.5 billion of corporate debt, $20.5 billion in equities, and $32.4 billion in agency debt, according to the report.

To contact the reporter on this story: Sarah McGregor in Washington at smcgregor5@bloomberg.net To contact the editors responsible for this story: Brendan Murray at brmurray@bloomberg.net Randall Woods

copyright

© 2016 Bloomberg L.P

No Comment