Hedge Funds Find an Unlikely Savior. He Won’t Be Happy: Gadfly

(Bloomberg Gadfly) —The past two years have been tough on hedge funds, and active money managers in general. Sitting on an index fund provided better returns in almost every asset class.

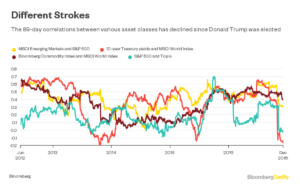

Donald Trump’s election as president of the U.S., however, has offered these managers a new lease of life. Since the New York real estate tycoon’s victory, the tight correlations between assets that have characterized markets in recent years have crumbled.

Because a Trump administration would pursue a more active fiscal policy including the promise of $1 trillion in infrastructure spending, investors have started to believe inflation will return and prompt central banks to taper or reverse their record monetary easing. That shift will affect the value of investments in different ways.

The collapse in correlations is the best news that hedge funds could have hoped for. Most active strategies seek to generate gains by identifying under- or overpriced assets, valuation anomalies that investors bet will correct themselves over time. Often, the approach involves buying one market or security while selling another.

That long-short strategy is rendered powerless when everything rises and falls in tandem. If, say, a fund manager was betting that emerging markets would drop while the S&P 500 would rise and instead both move higher together, then the profit (if any) would be smaller than if the investor had just bought the U.S. index alone.

This helps explain why the Hedge Fund Research Global Index is up only 1.9 percent this year and remains 5 percent below the high reached in April 2015. The period has been marked by unusually high correlations.

Obviously, not all active managers are created equal. While the past two years may have been a tough time for most stock pickers, some have thrived. The more markets move independently of each other, the more opportunities there will be for the skilled to generate excess returns, though.

Gain in Hedge Fund Research Global Index this year: 1.9%

Correlations are breaking down not only among asset classes but within them, too. A measure of returns investors get from different sectors within the U.S. stock market is showing the biggest disparities since 2009. The same is true for exchanges in emerging markets and among commodities. That’s all welcome news for an industry that’s been struggling to justify the high fees it charges.

The irony will not be lost on fund managers. As a candidate, Donald Trump railed against hedge funds, saying they were “getting away with murder.” Far from being their nemesis, he may turn out to have been their savior.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

No Comment