Starbucks’s New CEO Kevin Johnson Has a Lot to Prove: Gadfly

published Dec 1st 2016, 5:04 pm, by Shelly Banjo

(Bloomberg Gadfly) —

New blood is good, right? Well, not exactly.

Starbucks Corp.’s stock dropped as much as 10 percent in after-market trading Thursday on news that CEO Howard Schultz is stepping down from the coffee chain he bought in 1987 and transformed into an $86 billion company.

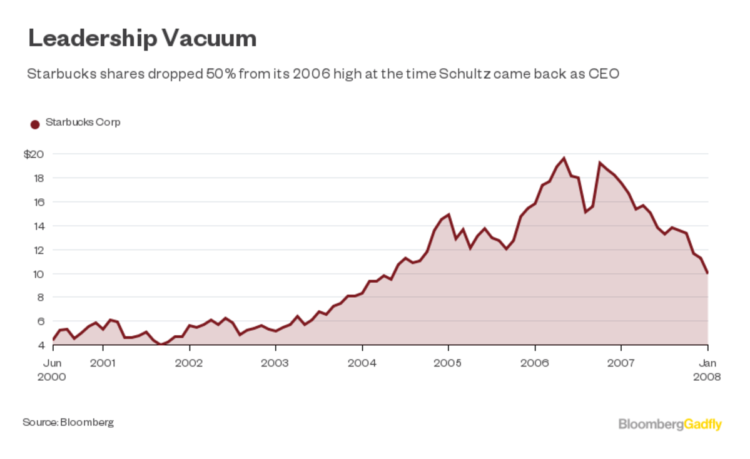

This reaction isn’t surprising: The last time Schultz stepped away from the company — from 2000 to 2008 — Starbucks’s sales had their worst performance since the company went public. During that time, it posted five straight years of comparable-store sales growth declines. Its stock fell 50 percent from its 2006 high.

When Schultz came back, he gave Starbucks a much-needed energy boost. He slowed U.S. store openings to re-establish the chain as a premium brand, accelerated international expansion, and streamlined bureaucracy. The company perked up big time, with shares shooting up nearly 1200 percent since then.

1200%

Schultz was also ahead of the game on technology, ushering in a successful mobile-payment and digital-ordering system that sped up orders and engendered loyalty among customers.

Which brings us to Schultz’s reasoning for stepping aside: On a call with Wall Street analysts Thursday, Schultz said his successor, former Microsoft executive Kevin Johnson, was much better equipped than he was to continue Starbucks’s foray into the digital world. (Though Schultz stressed he would remain as chairman of the board and focus on Starbucks’s move into higher-end, premium line of shops.)

It’s likely we will hear more about the company’s new strategic plans at its annual investor meeting later this month, but in the meantime, here’s a short list of issues Johnson should attack right away:

Food: Starbucks’s food fight has gone on for decades at this point. The company is terrific at driving coffee sales; food sales, not so much. And that’s despite a buffet of deals over the years to try to get people to buy more food at its stores. The coffee chain recently bought a stake in Princi, a high-end Italian bakery and pizzeria. But investors and customers need to see more convincing proof Starbucks has found a way to crack its food conundrum. Loyalty program: Recent changes to Starbucks’s loyalty program look good, in theory. The company should be able to juice sales by encouraging customers to spend more. But the initial reaction hasn’t been great. There’s a lot more work to be done here to make sure loyal customers don’t get frustrated with the new system and abandon Starbucks for its competitors. Restaurant recession: From a macro perspective, Starbucks is also up against some real struggles in the retail and restaurant industries. Retail and mall traffic are in secular decline. And people are spending less on restaurants as they can find cheaper stuff at the grocery store. Starbucks should reach into its 2008 playbook and figure out how to offer premium products its competitors lack, in order to keep customers coming back and paying ever-higher prices.

When asked Thursday why history wouldn’t repeat itself upon his second departure, Schultz said he had more confidence in the current management team this time. Personally, he said he was more prepared to step down than he was the first time.

That may be so, but Schultz is again leaving the company at a tenuous time. It’s still not clear Kevin Johnson is ready to take the reins.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Shelly Banjo is a Bloomberg Gadfly columnist covering retail and consumer goods. She previously was a reporter at Quartz and the Wall Street Journal.

To contact the author of this story: Shelly Banjo in New York at sbanjo@bloomberg.net To contact the editor responsible for this story: Mark Gongloff at mgongloff1@bloomberg.net

copyright

© 2016 Bloomberg L.P

No Comment