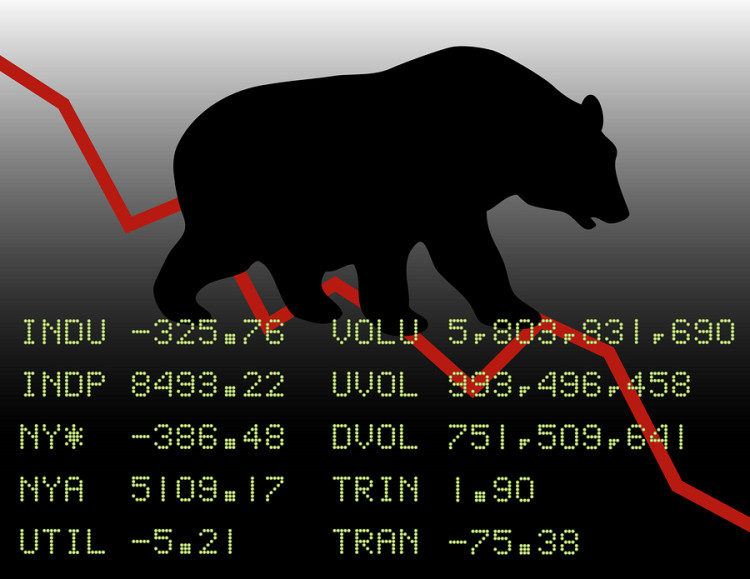

U.S. Stocks Sink With Markets Around the World as Rout Deepens

©2016 Bloomberg News

O19U9E6KLVRI

(Bloomberg) — U.S. stocks fell, with the Standard & Poor’s 500 Index reaching a 21-month low, following a renewed selloff across stocks worldwide as skepticism about the strength of the global economy intensified.

A late-day rally paced by health-care and small-cap shares helped trim declines, with the Nasdaq Composite Index briefly erasing a drop of as much as 3.7 percent. The Dow Jones Industrial Average and S&P 500 cut their worst losses by more than half. Energy companies sank further into five-year lows as oil plunged. International Business Machines Corp. fell to the lowest since 2010 after its earnings forecast missed projections.

The S&P 500 dropped 1.2 percent to 1,859.33 at 4 p.m. in New York, closing at its lowest level since April 2014. The gauge pared a slide of more than 3.6 percent. After falling more than 560 points, the Dow finished down 249.28 points, or 1.6 percent, to 15,766.74. The Nasdaq Composite slipped 0.1 percent, and the Russell 2000 Index wiped out a 3.7 percent selloff to close 0.5 percent higher.

“We were oversold and we didn’t keep falling off the table,” said Walter “Bucky” Hellwig, who helps manage $17 billion as a senior vice president at BB&T Wealth Management in Birmingham, Alabama. “The last-hour strength is positive, and I think it’s due to the fact that investors are saying, ‘This thing is oversold, I’m going to put some money to work,’ and it’s worked out better than buying it on the up days and then watching it disappear.”

Even with the final-hour rebound, the selling remained broad-based, with six of the S&P 500’s 10 main groups falling at least 1.3 percent. Exxon Mobil Corp. sank 4.2 percent, the most since August, and banks fell for a third day with Citigroup Inc. and Bank of America Corp. down more than 3.4 percent.

Global equities’ worst-ever start to a year deepened as oil continued its collapse and a slowdown in China weighs on sentiment. Japanese shares joined benchmark indexes in China and Europe in tumbling into a bear market today. West Texas Intermediate crude futures slumped 6.7 percent to $26.55 a barrel.

“What the market is focused on is Chinese hard-landing fear, oil prices and the strength in the dollar,” said Phil Orlando, who helps oversee $360 billion as chief equity-market strategist at Federated Investors Inc. in New York. “We haven’t hit bottom yet. That’s when we start talking about the need to retest the summer lows and holding at that level to take us to long-term support.”

About $2.2 trillion has been wiped off the value of U.S. stocks this year through yesterday, with the S&P 500 down 9 percent. And any rallies are getting shakier: nerves are weakening in a market where everything from China to oil and the Federal Reserve are proving capable of knocking equities down at any time. It’s a reversal of the optimism that underpinned the last three years of the bull market, when traders viewed bad news as transitory and used declines as opportunities to buy the dip.

The S&P 500’s plunge triggered a technical signal that indicates it’s oversold. The gauge’s relative strength index, which measures whether gains or losses have been too fast to sustain, dipped to 30, a threshold that indicates a rebound may materialize. The RSI last fell below 30 on Jan. 13. The prior time it was that low was on Aug. 25, when the S&P 500 hit a bottom and rallied 6.5 percent over the next three days.

The main U.S. equity benchmark is nearly 13 percent below its all-time high set in May, after rallying to within 1 percent of the record as recently as Nov. 3. The S&P 500 trades at 14.9 times the forecast earnings of its members, in line with the index’s average of the past five years. It’s more expensive than developed markets in Europe, where the Stoxx 600 Index trades for 13.6 times estimated earnings.

Along with valuations, investors are keeping close watch on progress in the economy to gauge the potential pace of future interest-rate increases by the Federal Reserve. The central bank’s next policy meeting concludes a week from today.

Data Watch

Data today showed the cost of living in the U.S. dropped in December, led by a slump in commodities that’s roiling global markets. Excluding food and fuel, the so-called core index rose less than forecast with the smallest gain in four months. A separate report showed new-home construction unexpectedly fell in December, indicating the industry lost some momentum entering 2016.

Concerns about weaker growth are overshadowing the corporate earnings season, where most of the few companies that have reported so far have exceeded estimates. Verizon Communications Inc., General Electric Co. and Starbucks Corp. are among S&P companies scheduled to release financial results this week. Analysts predict profits slumped 7 percent in the final three months of 2015, while sales fell 3.1 percent.

“A few people are calling this a good buying opportunity, but nobody seems willing to really stick their neck out,” said Ross Yarrow, director of U.S. equities at Robert W. Baird & Co. in London. “All the concerns go back to China and oil. We’re already seeing a big impact in the lack of trade across the world. There isn’t much out there that can really support a lasting rally.”

The Chicago Board Options Exchange Volatility Index rose 5.9 percent Wednesday to 27.59, after jumping more than 23 percent. The measure of market turbulence known as the VIX has surged 51 percent so far in 2016. About 12.5 billion shares traded hands on U.S. exchanges, 67 percent above the three-month average.

Broad Declines

Nine of the S&P 500’s main groups fell today. Energy companies dropped 2.9 percent, while utilities and financial shares tumbled more than 2.1 percent to lead declines. Devon Energy Corp. fell 8.1 percent, while ConocoPhillips and Halliburton Co. declined more than 4.4 percent.

Financial companies were the biggest drag on the benchmark index, led by banks. JPMorgan Chase & Co. dropped 2.6 percent, Bank of America fell to a more than two-year low and Citigroup sank to a three-year nadir. Among the broader group, Charles Schwab Corp. decreased 4.7 percent.

Consumer discretionary companies, one of the few industries to finish with gains Tuesday, erased the advance today, falling 1 percent. Wynn Resorts Ltd. dropped 4.7 percent, paring an earlier 11 percent tumble. Netflix Inc. was little changed, after earlier losing 10 percent. The online video company reported stronger-than-expected subscriber additions worldwide last quarter, though growth in U.S. subscribers was less than anticipated.

Tiffany & Co. and Target Corp. slumped more than 2.3 percent as retailers in the benchmark fell to a three-month low. Home Depot Inc. lost 2.8 percent, falling for the fourth time in five days.

IBM paced the retreat among technology companies, down 4.9 percent, while Cisco Systems Inc. and Yahoo! Inc. decreased more than 3.2 percent. Apple Inc. erased a 3.4 percent selloff to close little changed. Twitter Inc. surged as much as 14 percent from an all-time low yesterday amid takeover speculation.

Drug developers were outliers amid the market’s pullback, with the Nasdaq Biotechnology Index erasing an earlier 3.3 percent drop to rally 2.7 percent. Celgene Corp. and Regeneron Pharmaceuticals Inc. increased more than 3.3 percent.

–With assistance from Yuko Takeo, Tom Redmond, Sofia Horta e Costa and Oliver Renick.

To contact the reporters on this story: Dani Burger in New York at dburger7@bloomberg.net; Anna-Louise Jackson in New York at ajackson36@bloomberg.net To contact the editors responsible for this story: Cecile Vannucci at cvannucci1@bloomberg.net John Shipman

No Comment