Oil Slides as Venezuela Sees Mid-$20 Crude If OPEC Doesn’t Act

©2015 Bloomberg News

NY8T776JTSEK

(Bloomberg) — Oil extended its decline as Venezuela predicted prices may drop as low as the mid-$20s a barrel unless the Organization of Petroleum Exporting Countries takes action to stabilize the market.

January futures fell as much as 1.1 percent in New York after front-month prices slid 0.9 percent last week. Saudi Arabia and Qatar are considering Venezuela’s proposal for an equilibrium price of $88 a barrel, Venezuelan Oil Minister Eulogio Del Pino told reporters Sunday in Tehran. OPEC should make room for increased Iranian crude production within its ceiling of 30 million barrels a day, the nation’s Oil Minister Bijan Namdar Zanganeh said.

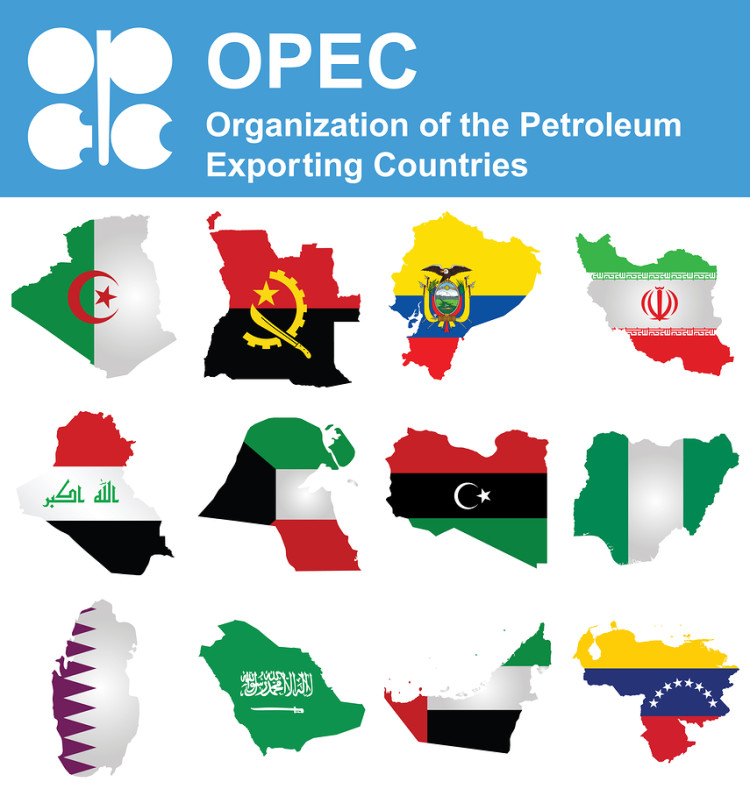

Oil has slumped about 45 percent the past year amid speculation a global glut with persist as OPEC continues to pump above its collective quota. The 12-member group meets Dec. 4 in Vienna to discuss the production ceiling as Iran signals its intention to boost output by 1 million barrels a day within five to six months of economic sanctions being removed.

“Any meaningful change from OPEC has to come from the big producers led by Saudi Arabia,” Ric Spooner, a chief analyst at CMC Markets in Sydney, said by phone. “While an increase in Iranian production is not a surprise, it will be a negative when it hits the market.”

West Texas Intermediate for January delivery dropped as much as 47 cents to $41.43 a barrel on the New York Mercantile Exchange and was at $41.59 at 8:41 a.m. Hong Kong time. The December contract expired Friday after declining 0.4 percent to close at $40.39, the lowest settlement since Aug. 26. The volume of all futures traded was about 43 percent above the 100-day average.

Brent for January settlement was 10 cents lower at $44.56 a barrel on the London-based ICE Futures Europe exchange. The contract rose 48 cents to $44.66 Friday. The European benchmark crude traded at a premium of $3 to WTI.

To contact the reporter on this story: Ben Sharples in Melbourne at bsharples@bloomberg.net To contact the editors responsible for this story: Ramsey Al-Rikabi at ralrikabi@bloomberg.net Sungwoo Park

No Comment