Gasoline Surges, Oil Steady as Harvey Shuts Texas Refineries

(Bloomberg) —Gasoline surged and oil was steady as flooding from Tropical Storm Harvey inundated refining centers along the Texas coast, shutting more than 10 percent of U.S. fuel-making capacity.

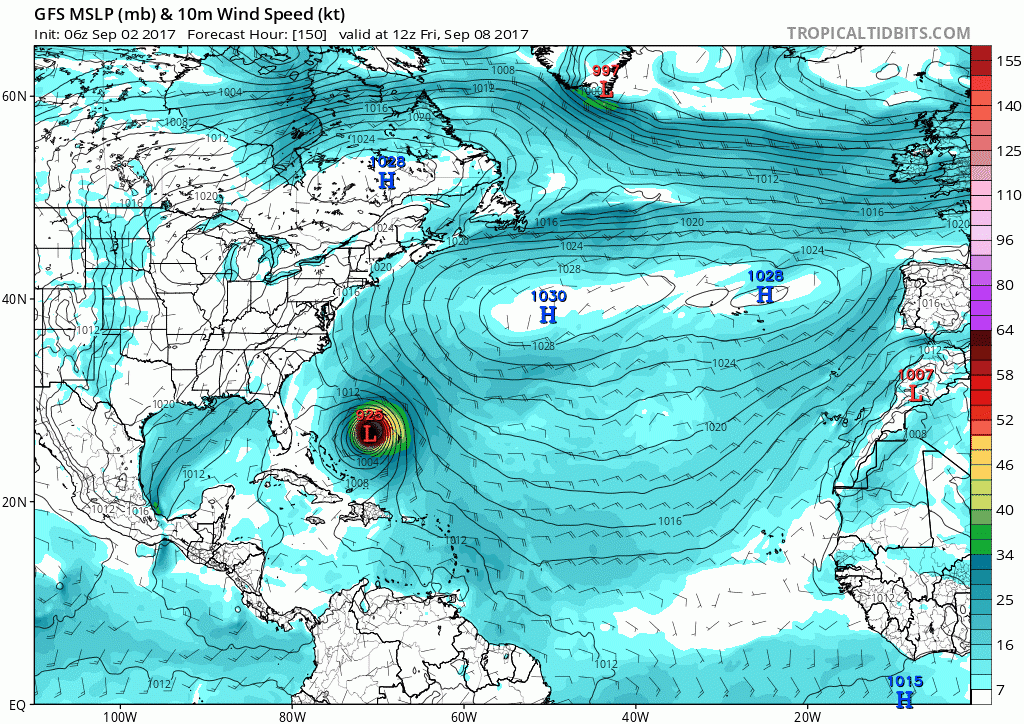

Front-month gasoline futures jumped as much as 6.8 percent while oil added 0.3 percent. Harvey, the strongest storm to hit the U.S. since 2004, made landfall as a Category 4 hurricane Friday, with torrential rain flooding cities from Corpus Christi to Houston and shutting plants able to process some 2.26 million barrels a day of oil. Major terminals and pipelines that move crude and fuel into and out of Houston-area refineries were also shut, potentially stranding some crude in West Texas and starving New York Harbor of gasoline.

Gasoline prices are going to continue to rise this week as we expect another three days of rain in the Houston area, Andy Lipow, president of consultant Lipow Oil Associates LLC in Houston, said by telephone. “With pipeline operators beginning to shut down their crude oil and refined product infrastructure, I expect to see further curtailment of refinery operations, resulting in less product being available. A spike in gasoline and diesel prices will drag up crude oil prices.

Oil has traded in a tight range this month, as output cuts by the members of the Organization of Petroleum Exporting Countries and its allies are thought to be negated by production elsewhere. As Harvey led to widespread flooding, refineries such as Royal Dutch Shell Plc’s Deer Park, Texas plant and Exxon Mobil Corp.’s Baytown complex shut and Magellan Midstream Partners LP suspended its inbound and outbound refined products and crude pipeline transportation services in the Houston area.

Prices will likely rise just because of worries, but the real impact might not be clear for a couple of days, Michael Lynch, president of Strategic Energy & Economic Research in Winchester, Massachusetts, said by email.

Front-month gasoline futures rose by as much as 6.8 percent to $1.7799 a gallon on the New York Mercantile Exchange. West Texas Intermediate for October delivery added 16 cents to $48.03 a barrel.

Brent for October settlement added 0.8 percent to $52.81 a barrel on the London-based ICE Futures Europe exchange. The global benchmark crude traded at a premium of $4.77 to WTI.

An estimated 300,000 to 500,000 barrels a day of Eagle Ford oil output has been shut, according to the Texas Railroad Commission. About 22 percent, or 378,600 barrels a day of Gulf of Mexico oil production is offline, according to the Bureau of Safety and Environmental Enforcement. Magellan also said the Longhorn and Bridgetex crude pipelines, capable of hauling a combined 675,000 barrels a day of crude from West Texas to Houston, are shut.

No Comment