Dollar’s Trump-Inspired Surge Sets Off Intervention Across Asia

published Nov 11th 2016, 4:11 pm, by Narayanan Somasundaram and Lananh Nguyen

(Bloomberg) —

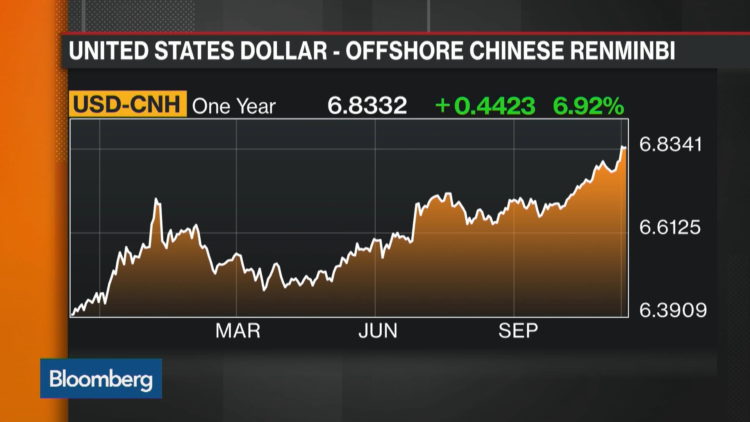

The dollar had its best week since 2011, spurring central banks from India to Indonesia to step in to stabilize their currencies on concern that U.S. President-elect Donald Trump will pursue policies that spur capital outflows from developing economies.

The Indonesian rupiah and South Korean won were among the day’s worst performers against the greenback on speculation Trump’s policies will weaken exports from emerging nations. Trump has signaled he’ll adopt more protectionist trade policies, while introducing fiscal stimulus that has potential to hasten interest-rate increases by the Federal Reserve.

“We are seeing carnage in Asian FX markets,” said Robert Rennie, head of financial markets strategy at Westpac Banking Corp. in Sydney. “It’s providing a very strong reminder that the S&P 500 is not the correct barometer of Trump-driven risk aversion — it’s Asian currencies.”

The Bloomberg Dollar Spot Index, which tracks the currency against 10 major peers rose about 2.8 percent for the week, the most since September 2011. The greenback reached the strongest since March against the euro, and traded at about $1.0855.

The rupiah reached a five-month low against the greenback, according to prices from local banks compiled by Bloomberg. Emerging-market currencies had their worst three-day rout since 2011 and the Indian rupee dropped the most in more than four months.

“Contrary to ideas of ‘race to the bottom’ or ‘currency wars’ where ‘everyone’ wants weaker currencies, a number of Asian central banks are believed to have sold dollars and bought their own currencies to slow the descent,” Marc Chandler, global head of currency strategy in New York at Brown Brothers Harriman & Co., wrote in a note.

Stepping In

Indonesia’s monetary authority is already in the market to stabilize the rupiah, and doesn’t see much fund outflows and expects the move to be temporary, Nanang Hendarsah, head of financial-market deepening at the nation’s central bank, said in a text message. Bank Negara Malaysia Governor Muhammad Ibrahim said the monetary authority’s role is to continue managing “extreme volatilities in the ringgit with no targeted level.”

Indian state-run banks sold dollars on behalf of the Reserve Bank, according to two Mumbai-based traders, who asked not to be identified. Former Governor Raghuram Rajan had said the central bank intervenes to curb volatility and doesn’t target any particular rupee level.

The Singapore dollar climbed, snapping a two-day drop, after the nation’s central bank said it was ready to curb excessive currency volatility if needed.

‘Freight Train’

“It’s more a smoothing action because of the velocity of the moves today,” said Jeffrey Halley, a market strategist at Oanda Asia Pacific Pte in Singapore. “They’re not going to try to stand in front of a freight train. We may see more of this going forward. A lot of these emerging markets are going to have quite a lot of work to do vis-a-vis managing their currencies.”

Investors are betting Trump will cut taxes, ramp up infrastructure spending to spur economic growth and inflation, triggering Fed rate increases. Traders see an 84 percent probability of a quarter-point hike at the central bank’s December meeting, according to pricing in federal funds futures.

After Trump’s election, benchmark 10-year Treasury yields climbed above 2 percent for the first time since January on speculation the likely spending to spur growth will quicken inflation. Trump’s proposals include pledges to cut taxes and spend as much as $500 billion on infrastructure.

“The market’s tone remains negative on bonds, emerging markets, positive on U.S. stocks and the dollar,” said Nizam Idris, head of foreign-exchange and fixed-income strategy at Macquarie Bank Ltd. in Singapore.

–With assistance from Liau Y-Sing and Netty Ismail. To contact the reporters on this story: Narayanan Somasundaram in Sydney at nsomasundara@bloomberg.net ;Lananh Nguyen in New York at lnguyen35@bloomberg.net To contact the editors responsible for this story: Garfield Reynolds at greynolds1@bloomberg.net Jonathan Annells, Naoto Hosoda

copyright

© 2016 Bloomberg L.P

No Comment