Hillary Clinton to Propose High-Frequency Trading Tax, Volcker Rule Changes

©2015 Bloomberg News

NVVPDZ6S972H

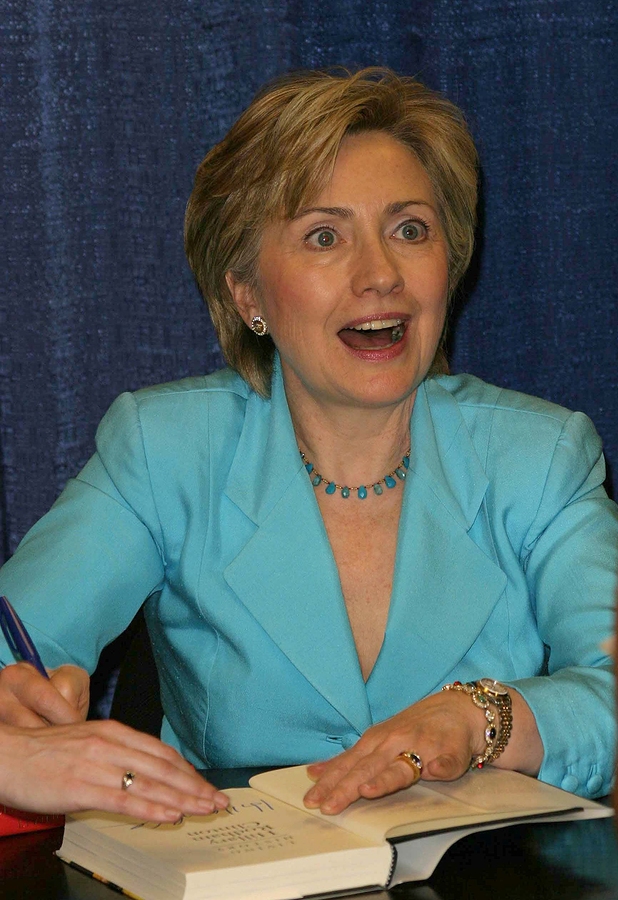

(Bloomberg) — Hillary Clinton will propose a tax aimed at penalizing “harmful” high-frequency trading strategies and offer ways to strengthen the Volcker Rule, among other measures, as she unveils another set of proposals Thursday aimed at what she has termed risky Wall Street behavior.

The Democratic presidential front-runner plans to call for a tax targeting trading strategies that rely heavily on order cancellations, a Clinton aide said Wednesday, previewing her announcements on the condition of anonymity.

In what her campaign is billing this as an effort to put the interests of the investing public before those of high- frequency traders and “dark pools,” where securities are traded privately, Clinton will suggest that the Securities and Exchange Commission launch an overhaul of stock market rules to allow for equal access to markets, greater transparency and the minimization of conflicts of interest.

She will also suggest adjusting the Volcker Rule, by eliminating a provision that allows banks to invest up to three percent of their capital in hedge funds and reinstating the “swaps push-out” rule of Dodd-Frank, which was removed last year. Former Massachusetts Representative Barney Frank, the coauthor of the bill, has been advising Clinton and her team.

Clinton’s targeting of high frequency trading may amount to her most meaningful punitive move against Wall Street so far. The proposal to target cancelled orders will crimp the style of the traders author Michael Lewis dubbed “flash boys” and could take aim at the practice of spoofing, the practice of rapidly submitting fake orders and then withdrawing them to try to move asset prices in a desired direction.

The Justice Department and the Commodity Futures Trading Commission recently accused a London trader of spoofing that contributed to the May 2010 flash crash, when close to $1 trillion in U.S. stock value vanished in minutes before prices recovered.

Though Clinton, who served eight years as a senator from New York, has considerable Wall Street backing, she is under pressure from the left wing of her party — led by Senator Elizabeth Warren of Massachusetts and Vermont Senator Bernie Sanders, now Clinton’s chief rival for the nomination. In Bloomberg focus groups earlier this week, voters cited Sanders’ championing of middle class workers as a reason for his appeal.

Her latest proposals suggest she’s doubling down on a bet that she can risk alienating wealthy donors more than the liberal base of her party.

Ever since she launched her campaign earlier this year, Clinton has sounded a markedly populist note. “We also have to go beyond Dodd-Frank. Too many financial institutions are still too complex and too risky,” she said in July. Her latest salvo on Wall Street comes one day after Clinton offered a major concession to labor, breaking the Obama administration she served and, arguably, with the trade policies of her husband in announcing her opposition to the Trans-Pacific Partnership. President Bill Clinton signed the NAFTA pact which many union leaders blame for offshoring U.S. jobs.

Clinton will also offer proposals to beef up individual accountability, calling for corporate fines for wrongdoing to come with penalties that hit workers’ bonuses and extending the statute of limitations for major financial fraud to 10 years.

The Democrat has framed her push to get tough on Wall Street as part of a philosophy of “clear-eyed capitalism,” making sure that fairness for all is part of the equation.

“I believe we have to build a growth and fairness economy. You can’t have one without the other,” she said in July during her first major economic speech of the campaign, at the New School University in New York. “We can’t create enough jobs and new businesses without more growth, and we can’t build strong families and support our consumer economy without more fairness.”

(Contributing: Jesse Westbrook)

To contact the author of this story: Jennifer Epstein in New York at jepstein32@bloomberg.net To contact the editor responsible for this story: Kathy Kiely at kkiely9@bloomberg.net

No Comment