Bloomberg Business: Dollar Declines as Post-Fed Adjustment Continues for Traders

©2015 Bloomberg News

NLS6416TTDS7

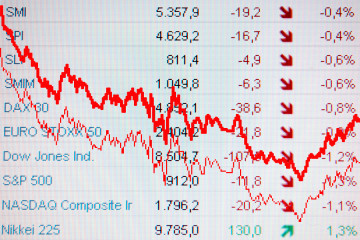

(Bloomberg) — The dollar declined as unexpectedly weak economic data has investors adjusting their outlook in the wake of last week’s Federal Reserve meeting. Orders for durable goods dropped in February, extending the greenback’s losses after it slid the most in more than three years last week as the Federal Open Market Committee cut projections for future rates, inflation and growth. A gauge of expected currency swings has jumped during the past month. “The dollar is vulnerable to U.S. economic data surprises, and soft prints are likely to keep it on the back foot,” Mark McCormick, a foreign-exchange strategist at Credit Agricole SA in New York, said by e-mail. The dollar weakened 0.4 percent to $1.0964 per euro as of 2:30 p.m. in New York, and dropped 0.1 percent to 119.62 yen. The euro added 0.3 percent to 131.16 yen. The Bloomberg Dollar Spot Index, which tracks the U.S. currency against 10 major peers, slid less than 0.1 percent to 1,185.54 after tumbling 2.2 percent last week, the biggest weekly decline since October 2011. Deutsche Bank AG’s CVIX index of implied volatility for nine major currency pairs was at 10.65 percentage points, up from 9 a month earlier and more than double its lowest in at least 14 years of 4.9 reached in July 2014. It’s 10-year average is 10.18.

‘Slowing Down’

The dollar depreciated as bookings for goods meant to last at least three years declined 1.4 percent after a 2 percent gain in January that was smaller than previously estimated, data from the Commerce Department showed Wednesday in Washington. The median forecast of 81 economists surveyed by Bloomberg estimated durable goods orders would rise 0.2 percent.

Any U.S. economic data that miss expectations are “going to punish the dollar.” Alfonso Esparza, a senior currency analyst at Oanda Corp. in Toronto, said in a telephone interview. “Short-term dollar weakness is expected.” The dollar has gained against 13 or its 16 major peers this quarter, adding 9.3 percent versus the euro, as traders speculated on the Fed raising borrowing costs this year. Policy makers last week pushed backs bets on a rise in interest rates any time soon, indicating they were in no rush for the first increase since 2006 and will monitor data for policy direction. The Fed’s target borrowing rate has been held at zero to 0.25 percent since 2008 to boost growth. “There are more important data points for the Fed than durable goods, so I don’t think this is by any means a make-or- break number for a June versus July or September hike,” Matt Derr, a foreign-exchange strategist at Credit Suisse Group AG in New York, said by e-mail. “However, it certainly doesn’t help.”

–With assistance from Chikako Mogi and Kevin Buckland in Tokyo, David Goodman in London and Mika Otsuka in New York.

To contact the reporters on this story: Lananh Nguyen in New York at lnguyen35@bloomberg.net; Andrea Wong in New York at awong268@bloomberg.net To contact the editors responsible for this story: Dave Liedtka at dliedtka@bloomberg.net Kenneth Pringle, Paul Cox

No Comment